US Cellular 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11MAR201618343100

11MAR201618465399 11MAR201618464613

EXECUTIVE OVERVIEW

Management’s Discussion and Analysis of Financial Condition and Results of Operations (‘‘MD&A’’) should be read in

conjunction with the Financial Statements and Notes to Consolidated Financial Statements for the year ended

December 31, 2015. This report contains statements that are not based on historical facts, including the words

‘‘believes,’’ ‘‘anticipates,’’ ‘‘intends,’’ ‘‘expects’’ and similar words. These statements constitute and represent ‘‘forward

looking statements’’ as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking

statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or

developments to be significantly different from any future results, events or developments expressed or implied by such

forward looking statements.

TDS uses certain ‘‘non-GAAP financial measures’’ throughout the MD&A. A discussion of the reason TDS uses these

measures and a reconciliation to their most directly comparable GAAP financial measure is included in the Supplemental

Information section within this MD&A.

General

Telephone and Data Systems, Inc. (‘‘TDS’’) is a diversified telecommunications company that provides high-quality

telecommunications services to approximately 6 million customers nationwide. TDS provides wireless services through its

84%-owned subsidiary, United States Cellular Corporation (‘‘U.S. Cellular’’). TDS also provides wireline services, cable

services and hosted and managed services (‘‘HMS’’), through its wholly-owned subsidiary, TDS Telecommunications

Corporation (‘‘TDS Telecom’’). TDS’ segments operate almost entirely in the United States. See Note 18 — Business

Segment Information in the Notes to Consolidated Financial Statements for summary financial information on each

business segment.

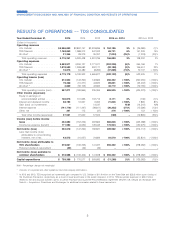

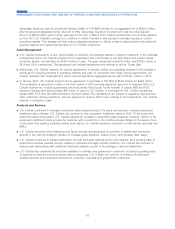

2015 Operating Revenues 2015 Adjusted EBITDA*

77%

14%

3% 6%

Wireless

Wireline

Cable

HMS

Wireless

Wireline

Cable

HMS

74%

22%

3%1%

* Represents a non-GAAP financial measure. Refer to Supplemental Information within this MD&A for a reconciliation of this measure.

TDS Mission and Strategy

TDS’ mission is to provide outstanding communications services to its customers and meet the needs of its

shareholders, its people, and its communities. In pursuing this mission, TDS seeks to profitably grow its businesses,

create opportunities for its associates and employees, and steadily build value over the long-term for its shareholders.

Across all of its businesses, TDS is focused on providing exceptional customer experiences through best-in-class

services and products and superior customer service.

TDS’ long-term strategy calls for the majority of its capital to be reinvested in its operating businesses to strengthen their

competitive positions, while still returning value to TDS shareholders through the payment of a regular quarterly cash

dividend and share repurchases.

1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS