US Cellular 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

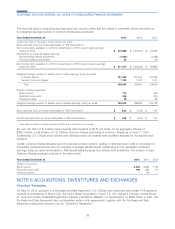

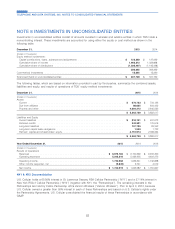

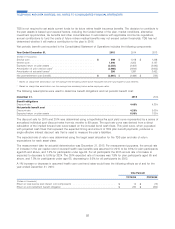

The following table summarizes the terms of such revolving credit facilities as of December 31, 2015:

TDS U.S. Cellular

(Dollars in millions)

Maximum borrowing capacity ............................................ $ 400.0 $ 300.0

Letters of credit outstanding ............................................. $ 0.6 $ 17.5

Amount borrowed ................................................... $ – $ –

Amount available for use ............................................... $ 399.4 $ 282.5

Illustrative borrowing rate: One-month London Interbank Offered Rate (‘‘LIBOR’’) plus contractual

spread1........................................................ 2.18% 2.18%

Illustrative LIBOR Rate ............................................... 0.43% 0.43%

Contractual spread ................................................. 1.75% 1.75%

Commitment fees on amount available for use2................................. 0.30% 0.30%

Agreement date .................................................... Dec 2010 Dec 2010

Maturity date ...................................................... Dec 2017 Dec 2017

Fees incurred attributable to the Revolving Credit Facility are as follows:

Fees incurred as a percent of Maximum borrowing capacity for 2015 .................. 0.33% 0.29%

Fees incurred, amount

2015 ........................................................ $ 1.3 $ 0.9

2014 ........................................................ $ 0.9 $ 3.0

2013 ........................................................ $ 0.9 $ 0.8

1Borrowings under the revolving credit facility bear interest at LIBOR plus a contractual spread based on TDS’ or U.S. Cellular’s credit rating or, at TDS’

or U.S. Cellular’s option, an alternate ‘‘Base Rate’’ as defined in the revolving credit agreement. TDS and U.S. Cellular may select a borrowing period of

either one, two, three or six months (or other period of twelve months or less if requested by TDS or U.S. Cellular and approved by the lenders).

2The revolving credit facility has commitment fees based on the unsecured senior debt ratings assigned to TDS and U.S. Cellular by certain ratings

agencies.

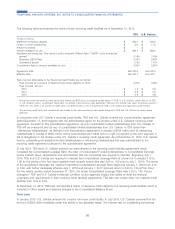

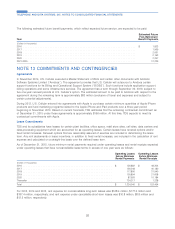

In connection with U.S. Cellular’s revolving credit facility, TDS and U.S. Cellular entered into a subordination agreement

dated December 17, 2010 together with the administrative agent for the lenders under U.S. Cellular’s revolving credit

agreement. Pursuant to this subordination agreement, (a) any consolidated funded indebtedness from U.S. Cellular to

TDS will be unsecured and (b) any (i) consolidated funded indebtedness from U.S. Cellular to TDS (other than

‘‘refinancing indebtedness’’ as defined in the subordination agreement) in excess of $105 million and (ii) refinancing

indebtedness in excess of $250 million will be subordinated and made junior in right of payment to the prior payment in

full of obligations to the lenders under U.S. Cellular’s revolving credit agreement. As of December 31, 2015, U.S. Cellular

had no outstanding consolidated funded indebtedness or refinancing indebtedness that was subordinated to the

revolving credit agreement pursuant to the subordination agreement.

In July 2014, TDS and U.S. Cellular entered into amendments to the revolving credit facilities agreements which

increased the Consolidated Leverage Ratio (the ratio of Consolidated Funded Indebtedness to Consolidated Earnings

before interest, taxes, depreciation and amortization) that the companies are required to maintain. Beginning July 1,

2014, TDS and U.S. Cellular are required to maintain the Consolidated Leverage Ratio at a level not to exceed 3.75 to

1.00 for the period of the four fiscal quarters most recently ended (this was 3.00 to 1.00 prior to July 1, 2014). The terms

of the amendment decrease the maximum permitted Consolidated Leverage Ratio beginning January 1, 2016 from 3.75

to 3.50, with further decreases effective July 1, 2016 and January 1, 2017 (and will return to 3.00 to 1.00 at that time).

For the twelve months ended December 31, 2015, the actual Consolidated Leverage Ratio was 2.25 to 1.00. Future

changes in TDS’ and U.S. Cellular’s financial condition could negatively impact their ability to meet the financial

covenants and requirements in their revolving credit facilities agreements. TDS also has certain other non-material credit

facilities from time to time.

At December 31, 2015, TDS had recorded $3.6 million of issuance costs related to the revolving credit facilities which is

included in Other assets and deferred charges in the Consolidated Balance Sheet.

Term Loan

In January 2015, U.S. Cellular entered into a senior term loan credit facility. In July 2015, U.S. Cellular borrowed the full

amount of $225 million available under this facility in two separate draws. The interest rate on outstanding borrowings

86

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS