US Cellular 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

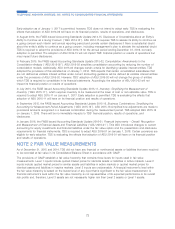

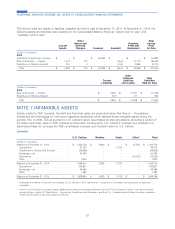

TDS has applied the provisions of fair value accounting for purposes of computing the fair value of financial instruments

for disclosure purposes as displayed below.

Level within

the Fair

Value December 31, 2015 December 31, 2014

Hierarchy Book Value Fair Value Book Value Fair Value

(Dollars in thousands)

Cash and cash equivalents ................ 1 $ 984,643 $ 984,643 $ 471,901 $ 471,901

Long-term debt

Retail ............................ 2 1,753,250 1,766,308 1,453,250 1,414,105

Institutional ......................... 2 533,015 501,461 532,722 513,647

Other ............................ 2 215,538 215,456 4,749 4,675

The fair value of Cash and cash equivalents approximates the book value due to the short-term nature of these financial

instruments. Long-term debt excludes capital lease obligations and the current portion of Long-term debt. The fair value

of ‘‘Retail’’ Long-term debt was estimated using market prices for TDS’ 7.0% Senior Notes, 6.875% Senior Notes,

6.625% Senior Notes and 5.875% Senior Notes, and U.S. Cellular’s 6.95% Senior Notes, 7.25% 2063 Senior Notes and

7.25% 2064 Senior Notes. TDS’ ‘‘Institutional’’ debt consists of U.S. Cellular’s 6.7% Senior Notes which are traded over

the counter. TDS’ ‘‘Other’’ debt consists of a senior term loan credit facility and other borrowings with financial

institutions. TDS estimated the fair value of its Institutional and Other debt through a discounted cash flow analysis using

the interest rates or estimated yield to maturity for each borrowing, which ranged from 0.00% to 7.51% and 0.00% to

7.25% at December 31, 2015 and 2014, respectively.

NOTE 3 EQUIPMENT INSTALLMENT PLANS

TDS offers customers through its owned and agent distribution channels the option to purchase certain devices under

equipment installment contracts over a specified time period. For certain equipment installment plans (‘‘EIP’’), after a

specified period of time or amount of payments, the customer may have the right to upgrade to a new device and have

the remaining unpaid equipment installment contract balance waived, subject to certain conditions, including trading in

the original device in good working condition and signing a new equipment installment contract. TDS values this trade-in

right as a guarantee liability. The guarantee liability is initially measured at fair value and is determined based on

assumptions including the probability and timing of the customer upgrading to a new device and the fair value of the

device being traded-in at the time of trade-in. As of December 31, 2015 and 2014, the guarantee liability related to these

plans was $92.7 million and $57.5 million, respectively, and is reflected in Customer deposits and deferred revenues in

the Consolidated Balance Sheet.

TDS equipment installment plans do not provide for explicit interest charges. For equipment installment plans with

duration of greater than twelve months, TDS imputes interest. Equipment installment plan receivables had a weighted

average effective imputed interest rate of 9.7% and 10.2% as of December 31, 2015 and 2014, respectively.

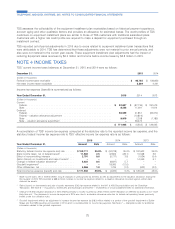

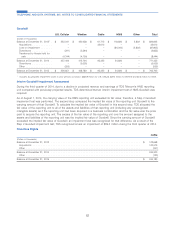

The following table summarizes the unbilled equipment installment plan receivables as of December 31, 2015 and 2014.

Such amounts are presented in the Consolidated Balance Sheet as Accounts receivable – customers and agents and

Other assets and deferred charges, where applicable.

December 31, 2015 2014

(Dollars in thousands)

Short-term portion of unbilled equipment installment plan receivables, gross ................... $ 278,709 $ 127,400

Short-term portion of unbilled deferred interest ..................................... (20,810) (16,365)

Short-term portion of unbilled allowance for credit losses ............................... (13,827) (3,686)

Short-term portion of unbilled equipment installment plan receivables, net ................... $ 244,072 $ 107,349

Long-term portion of unbilled equipment installment plan receivables, gross ................... $ 75,738 $ 89,435

Long-term portion of unbilled deferred interest ..................................... (2,283) (2,791)

Long-term portion of unbilled allowance for credit losses ............................... (5,537) (6,065)

Long-term portion of unbilled equipment installment plan receivables, net ................... $ 67,918 $ 80,579

74

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS