US Cellular 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ᔢAdvances or changes in technology could render certain technologies used by TDS obsolete, could put TDS at a

competitive disadvantage, could reduce TDS’ revenues or could increase its costs of doing business.

ᔢComplexities associated with deploying new technologies present substantial risk and TDS’ investments in unproven

technologies may not produce the benefits that TDS expects.

ᔢTDS receives regulatory support and is subject to numerous surcharges and fees from federal, state and local

governments, and the applicability and the amount of the support and fees are subject to great uncertainty.

ᔢPerformance under device purchase agreements could have a material adverse impact on TDS’ business, financial

condition or results of operations.

ᔢChanges in TDS’ enterprise value, changes in the market supply or demand for wireless licenses, wireline or cable

markets or IT service providers, adverse developments in the businesses or the industries in which TDS is involved

and/or other factors could require TDS to recognize impairments in the carrying value of its licenses, goodwill, franchise

rights and/or physical assets.

ᔢCosts, integration problems or other factors associated with acquisitions, divestitures or exchanges of properties or

licenses and/or expansion of TDS’ businesses could have an adverse effect on TDS’ business, financial condition or

results of operations.

ᔢTDS offers customers the option to purchase certain devices under installment contracts which, compared to fixed-term

service contracts, includes risks that TDS may possibly incur greater churn, lower cash flows, increased costs and/or

increased bad debts expense due to differences in contract terms, which could have an adverse impact on TDS’

financial condition or results of operations.

ᔢA failure by TDS to complete significant network construction and systems implementation activities as part of its plans

to improve the quality, coverage, capabilities and capacity of its networks and support systems could have an adverse

effect on its operations.

ᔢDifficulties involving third parties with which TDS does business, including changes in TDS’ relationships with or

financial or operational difficulties of key suppliers or independent agents and third party national retailers who market

TDS’ services, could adversely affect TDS’ business, financial condition or results of operations.

ᔢTDS has significant investments in entities that it does not control. Losses in the value of such investments could have

an adverse effect on TDS’ financial condition or results of operations.

ᔢA failure by TDS to maintain flexible and capable telecommunication networks or information technology, or a material

disruption thereof, could have an adverse effect on TDS’ business, financial condition or results of operations.

ᔢTDS has experienced and, in the future, expects to experience cyber-attacks or other breaches of network or

information technology security of varying degrees on a regular basis, which could have an adverse effect on TDS’

business, financial condition or results of operations.

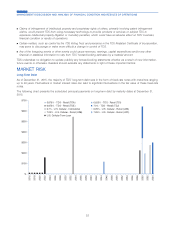

ᔢThe market price of TDS’ Common Shares is subject to fluctuations due to a variety of factors.

ᔢChanges in facts or circumstances, including new or additional information, could require TDS to record charges in

excess of amounts accrued in the financial statements, which could have an adverse effect on TDS’ business, financial

condition or results of operations.

ᔢDisruption in credit or other financial markets, a deterioration of U.S. or global economic conditions or other events

could, among other things, impede TDS’ access to or increase the cost of financing its operating and investment

activities and/or result in reduced revenues and lower operating income and cash flows, which would have an adverse

effect on TDS’ business, financial condition or results of operations.

ᔢSettlements, judgments, restraints on its current or future manner of doing business and/or legal costs resulting from

pending and future litigation could have an adverse effect on TDS’ business, financial condition or results of operations.

ᔢThe possible development of adverse precedent in litigation or conclusions in professional studies to the effect that

radio frequency emissions from wireless devices and/or cell sites cause harmful health consequences, including cancer

or tumors, or may interfere with various electronic medical devices such as pacemakers, could have an adverse effect

on TDS’ wireless business, financial condition or results of operations.

50

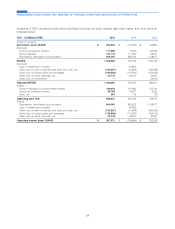

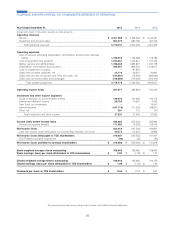

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS