US Cellular 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

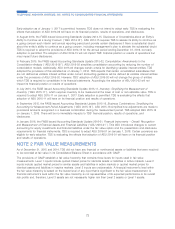

value of the unbuilt licenses is assumed to change by the same percentage, and in the same direction, that the fair

value of built licenses measured using the build-out method changed during the period. Based on the impairment

assessments performed, U.S. Cellular did not have an impairment of its Licenses in 2015 or 2014.

See Note 7 — Intangible Assets for additional details related to Licenses.

Goodwill

TDS has Goodwill as a result of its acquisition of wireless, wireline, cable and HMS companies and, under previous

business combination guidance in effect prior to 2009, step acquisitions related to U.S. Cellular’s repurchase of its

common shares. Such Goodwill represents the excess of the total purchase price over the fair value of net assets

acquired in these transactions. TDS performs its annual impairment assessment of Goodwill as of November 1 of each

year or more frequently if there are events or circumstances that cause TDS to believe the carrying value of individual

reporting units exceeds their respective fair values on a more likely than not basis.

See Note 7 — Intangible Assets for additional details related to Goodwill.

U.S. Cellular

For purposes of conducting its annual Goodwill impairment test as of November 1, 2015, U.S. Cellular identified one

reporting unit. In 2014, U.S. Cellular identified four reporting units based on four geographic groupings of operating

markets, representing four geographic service areas. Due to the evolution of the business and the extent to which U.S.

Cellular has similar customers, products and services, and operations across all geographic regions, and also operates

one interdependent network, U.S. Cellular determined it had one reporting unit as of November 1, 2015. The change in

reporting units required U.S. Cellular to perform an impairment test for both the previous four reporting units and one

new reporting unit as of November 1, 2015. A discounted cash flow approach was used to value each reporting unit for

purposes of the Goodwill impairment review. Based upon the impairment assessments performed, U.S. Cellular did not

have an impairment of its Goodwill in 2015 or 2014.

TDS Telecom

For purposes of conducting its annual Goodwill impairment test as of the November 1, 2015 and 2014, TDS Telecom

has identified three reporting units: Wireline, Cable and HMS. The discounted cash flow approach and guideline public

company method were used to value the Wireline and Cable reporting units for the 2015 and 2014 annual impairment

tests and the HMS reporting unit for the 2015 impairment test. For the 2014 annual impairment test, TDS Telecom

performed a qualitative assessment of the HMS reporting unit due to the interim impairment test performed on the HMS

reporting unit during the third quarter of 2014. Based on the impairment assessments performed, Wireline and Cable did

not have an impairment of their Goodwill in 2015 or 2014. HMS also did not have an impairment of its Goodwill in 2015;

however, HMS recognized a loss on impairment in 2014 as described in Note 7 — Intangible Assets.

Franchise Rights

TDS Telecom has Franchise rights as a result of acquisitions of cable businesses. Franchise rights are intangible assets

that provide their holder with the right to operate a business in a certain geographical location as sanctioned by the

franchiser, usually a government agency. TDS has determined that Franchise rights are indefinite-lived intangible assets

and, therefore, not subject to amortization because TDS expects both the renewal by the granting authorities and the

cash flows generated from the Franchise rights to continue indefinitely. Cable Franchise rights are generally granted for

ten year periods and may be renewed for additional terms upon approval by the granting authority. TDS anticipates that

future renewals of its Franchise rights will be granted.

TDS Telecom performs its annual impairment assessment of Franchise rights as of November 1 of each year or more

frequently if there are events or circumstances that cause TDS Telecom to believe the carrying value of Franchise rights

exceeds their fair value on a more likely than not basis. TDS Telecom tests Franchise rights for impairment at a unit of

accounting level for which one unit of accounting was identified. TDS Telecom estimates the fair value of franchise rights

for purposes of impairment testing using the build-out method. Based on the impairment assessments performed, TDS

Telecom did not have an impairment of Franchise rights in 2015 or 2014.

See Note 7 — Intangible Assets for additional details related to Franchise rights.

68

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS