US Cellular 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

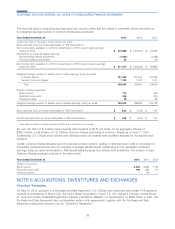

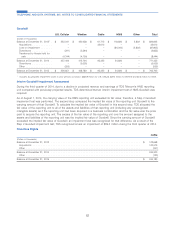

These agreements require Sprint to reimburse U.S. Cellular up to $200 million (the ‘‘Sprint Cost Reimbursement’’) for

certain network decommissioning costs, network site lease rent and termination costs, network access termination costs,

and employee termination benefits for specified engineering employees. As of December 31, 2015, U.S. Cellular had

received a cumulative total of $111.6 million pursuant to the Sprint Cost Reimbursement. Sprint Cost Reimbursement

totaling $30.0 million, $71.1 million and $10.6 million had been received and recorded in Cash received from divestitures

and exchanges in the Consolidated Statement of Cash Flows in 2015, 2014, and 2013, respectively.

As a result of the Divestiture Transaction, TDS recognized gains of $6.0 million, $29.3 million and $302.0 million in (Gain)

loss on sale of business and other exit costs, net, in 2015, 2014 and 2013, respectively.

Other Acquisitions, Divestitures and Exchanges

ᔢIn 2015, TDS sold certain Wireline markets for $25.6 million, including working capital adjustments, and recognized

aggregated gains of $9.5 million.

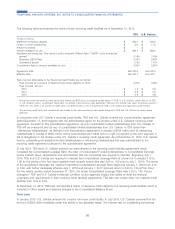

ᔢIn March 2015, U.S. Cellular exchanged certain of its unbuilt PCS licenses for certain other PCS licenses located in

U.S. Cellular’s existing operating markets and $117.0 million of cash. As of the transaction date, the licenses received

in the transaction had an estimated fair value, per a market approach, of $43.5 million. A gain of $125.2 million was

recorded in (Gain) loss on license sales and exchanges, net in the Consolidated Statement of Operations in the first

quarter of 2015.

ᔢU.S. Cellular participated in Auction 97 indirectly through its limited partnership interest in Advantage Spectrum.

Advantage Spectrum was the provisional winning bidder for 124 licenses for an aggregate winning bid of

$338.3 million, after its expected designated entity discount of 25%. Advantage Spectrum’s bid amount, less the

upfront payment of $60.0 million paid in 2014, was paid to the FCC in March 2015. These licenses have not yet been

granted by the FCC. See Note 14 — Variable Interest Entities for additional information.

ᔢIn December 2014, U.S. Cellular entered into an agreement with a third party to sell 595 towers and certain related

contracts, assets, and liabilities for $159.0 million. This agreement and related transactions are referred to as the

‘‘Tower Sale’’ and were accomplished in two closings. The first closing occurred in December 2014 and included the

sale of 236 towers, without tenants, for $10.0 million. On this same date, U.S. Cellular received $7.5 million in earnest

money. At the time of the first closing, a $4.7 million gain was recorded. The second closing for the remaining 359

towers, primarily with tenants, took place in January 2015, at which time U.S. Cellular received $141.8 million in

additional cash proceeds and TDS recorded a gain of $120.2 million in (Gain) loss on sale of business and other exit

costs, net.

ᔢIn September 2014, U.S. Cellular entered into an agreement with a third party to exchange certain PCS and AWS

licenses for certain other PCS and AWS licenses and $28.0 million of cash. This license exchange was accomplished

in two closings. The first closing occurred in December 2014 at which time U.S. Cellular transferred licenses to the

counterparty with a net book value of $11.5 million, received licenses with an estimated fair value, per a market

approach, of $51.5 million, recorded a $21.7 million gain and recorded an $18.3 million deferred credit in Other

current liabilities. The license that was transferred to the counterparty in the second closing had a net book value of

$22.2 million. The second closing occurred in July 2015. At the time of the second closing, U.S. Cellular received

$28.0 million in cash and recognized the deferred credit from the first closing, resulting in a total gain of $24.0 million

recorded on this part of the license exchange.

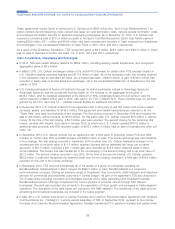

ᔢIn September 2014, TDS acquired substantially all of the assets of a group of companies operating as

BendBroadband, headquartered in Bend, Oregon for $260.7 million in cash. BendBroadband is a full-service

communications company, offering an extensive range of broadband, fiber connectivity, cable television and telephone

services for commercial and residential customers in Central Oregon. As part of the agreement, TDS also acquired a

Tier III data center providing colocation and managed services and a cable advertising and broadcast business.

BendBroadband service offerings complement the current portfolio of products offered through TDS Telecom

businesses. Goodwill was recorded due primarily to the expectation of future growth and synergies in Cable segment

operations. The operations of the data center are included in the HMS segment. The operations of the cable and the

advertising and broadcast businesses are included in the Cable segment.

ᔢIn May 2014, U.S. Cellular entered into a License Purchase and Customer Recommendation Agreement with Airadigm

Communications Inc. (‘‘Airadigm’’), a wholly-owned subsidiary of TDS. In September 2014, pursuant to the License

Purchase and Customer Recommendation Agreement, Airadigm transferred FCC spectrum licenses and certain tower

79

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS