US Cellular 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

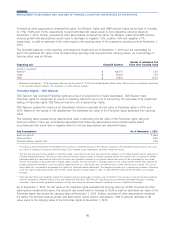

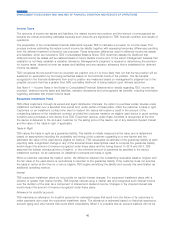

CONTRACTUAL AND OTHER OBLIGATIONS

At December 31, 2015, the resources required for contractual obligations were as follows:

Payments Due by Period

Less Than More Than

Total 1 Year 1 - 3 Years 3 - 5 Years 5 Years

(Dollars in millions)

Long-term debt obligations1.............. $ 2,527.2 $ 14.2 $ 23.3 $ 22.6 $ 2,467.1

Interest payments on long-term debt obligations . . 6,176.8 164.9 329.6 329.6 5,352.7

Operating leases2..................... 1,324.0 156.9 254.0 188.9 724.2

Capital leases ....................... 5.0 0.3 0.7 0.7 3.3

Purchase obligations3.................. 1,306.1 663.9 408.6 164.9 68.7

$ 11,339.1 $ 1,000.2 $ 1,016.2 $ 706.7 $ 8,616.0

1Includes current and long-term portions of debt obligations. The total long-term debt obligation differs from Long-term debt in the Consolidated Balance

Sheet due to capital leases, debt issuance costs and the unamortized discount related to U.S. Cellular’s 6.7% Senior Notes. See Note 11 — Debt in the

Notes to Consolidated Financial Statements for additional information.

2Includes future lease costs related to telecommunications plant facilities, office space, retail sites, cell sites, data centers and equipment. See

Note 13 — Commitments and Contingencies in the Notes to Consolidated Financial Statements for additional information.

3Includes obligations payable under non-cancellable contracts, commitments for network facilities and transport services, agreements for software

licensing, long-term marketing programs, and agreements with Apple to purchase certain minimum quantities of Apple iPhone products and fund

marketing programs related to the Apple iPhone and iPad products.

The table above excludes liabilities related to ‘‘unrecognized tax benefits’’ as defined by GAAP because TDS is unable

to predict the period of settlement of such liabilities. Such unrecognized tax benefits were $38.9 million at December 31,

2015. See Note 4 — Income Taxes in the Notes to Consolidated Financial Statements for additional information on

unrecognized tax benefits.

See Note 13 — Commitments and Contingencies in the Notes to Consolidated Financial Statements for additional

information.

CONSOLIDATED CASH FLOWS

TDS operates a capital- and marketing-intensive business. TDS utilizes cash on hand, cash from operating activities,

cash proceeds from divestitures and disposition of investments, short-term credit facilities and long-term debt financing

to fund its acquisitions (including licenses), construction costs, operating expenses and share repurchases. Cash flows

may fluctuate from quarter to quarter and year to year due to seasonality, the timing of acquisitions and divestitures,

capital expenditures and other factors. The following discussion summarizes TDS’ cash flow activities in 2015, 2014 and

2013.

2015 Commentary

Cash Flows from Operating Activities

Cash flows from operating activities were $789.7 million in 2015. An increase in cash flows from operating activities was

due primarily to improved net income and working capital factors. In 2015, increased receivables related to equipment

installment plans decreased cash flows from operating activities. In the near term and as the popularity of equipment

installment plans increases, TDS expects this trend to continue.

In December 2015, as part of the Protecting Americans from Tax Hikes Act of 2015, bonus depreciation was enacted

which allowed TDS to accelerate deductions for depreciation, resulting in an overpayment of estimated tax amounts paid

during 2015. Primarily as a result of this overpayment, TDS has recorded $70.1 million of Income taxes receivable at

December 31, 2015. TDS paid income taxes, net of refunds, of $57.4 million in 2015.

Future cash flows from operating activities may be impacted by distributions from investments in unconsolidated entities.

Distributions from unconsolidated entities in 2015, 2014 and 2013 were $60.1 million, $112.3 million and $127.9 million,

respectively. U.S. Cellular holds a 5.5% ownership interest in the LA Partnership. In 2014 and 2013, U.S. Cellular received

cash distributions of $60.5 million and $71.5 million, respectively, from the LA Partnership. U.S. Cellular did not receive

39

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS