US Cellular 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31MAR201601274243

ᔢClaims of infringement of intellectual property and proprietary rights of others, primarily involving patent infringement

claims, could prevent TDS from using necessary technology to provide products or services or subject TDS to

expensive intellectual property litigation or monetary penalties, which could have an adverse effect on TDS’ business,

financial condition or results of operations.

ᔢCertain matters, such as control by the TDS Voting Trust and provisions in the TDS Restated Certificate of Incorporation,

may serve to discourage or make more difficult a change in control of TDS.

ᔢAny of the foregoing events or other events could cause revenues, earnings, capital expenditures and/or any other

financial or statistical information to vary from TDS’ forward-looking estimates by a material amount.

TDS undertakes no obligation to update publicly any forward-looking statements whether as a result of new information,

future events or otherwise. Readers should evaluate any statements in light of these important factors.

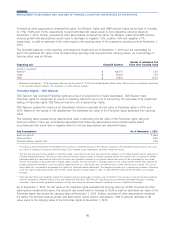

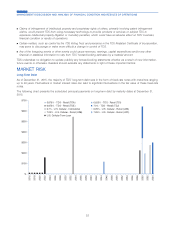

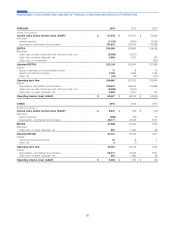

MARKET RISK

Long-Term Debt

As of December 31, 2015, the majority of TDS’ long-term debt was in the form of fixed-rate notes with maturities ranging

up to 49 years. Fluctuations in market interest rates can lead to significant fluctuations in the fair value of these fixed-rate

notes.

The following chart presents the scheduled principal payments on long-term debt by maturity dates at December 31,

2015:

$-

$100

$200

$300

$400

$500

$600

$700

2016

2018

2020

2022

2024

2026

2028

2030

2032

2034

2036

2038

2040

2042

2044

2046

2048

2050

2052

2054

2056

2058

2060

2062

2064

5.875% - TDS - Retail (TDA) 6.625% - TDS - Retail (TDI)

6.875% - TDS - Retail (TDE) 7.0% - TDS - Retail (TDJ)

6.7% - U.S. Cellular - Institutional 6.95% - U.S. Cellular - Retail (UZA)

7.25% - U.S. Cellular - Retail (UZB) 7.25% - U.S. Cellular - Retail (UZC)

U.S. Cellular Term Loan

51

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS