US Cellular 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

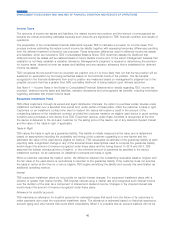

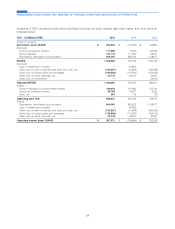

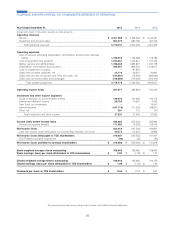

WIRELINE 2015 2014 2013

(Dollars in thousands)

Income (loss) before income taxes (GAAP)1................ $ 91,878 $ 103,541 $ 70,665

Add back:

Interest expense ................................... (1,133) (2,695) (3,265)

Depreciation, amortization and accretion .................... 165,841 169,044 170,868

EBITDA ......................................... 256,586 269,890 238,268

Add back:

(Gain) loss on sale of business and other exit costs, net .......... (9,530) (2,357) –

(Gain) loss on asset disposals, net ....................... 5,094 2,091 130

(Gain) loss on investments ............................ –– (830)

Adjusted EBITDA .................................. 252,150 269,624 237,568

Deduct:

Equity in earnings of unconsolidated entities ................. 17 819

Interest and dividend income ........................... 2,193 2,396 1,759

Other, net ....................................... (22) (32) (214)

Operating cash flow ................................ 249,962 267,252 236,004

Deduct:

Depreciation, amortization and accretion .................... 165,841 169,044 170,868

(Gain) loss on sale of business and other exit costs, net .......... (9,530) (2,357) –

(Gain) loss on asset disposals, net ....................... 5,094 2,091 130

Operating income (loss) (GAAP) ........................ $ 88,557 $ 98,474 $ 65,006

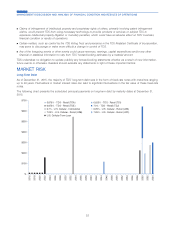

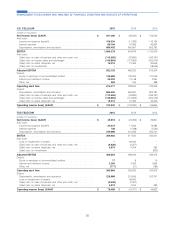

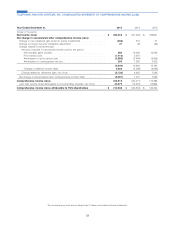

CABLE 2015 2014 2013

(Dollars in thousands)

Income (loss) before income taxes (GAAP)1................ $ 6,837 $ 392 $ (116)

Add back:

Interest expense ................................... (458) (95) 74

Depreciation, amortization and accretion .................... 35,271 23,643 7,571

EBITDA ......................................... 41,650 23,940 7,529

Add back:

(Gain) loss on asset disposals, net ....................... 691 2,482 28

Adjusted EBITDA .................................. 42,341 26,422 7,557

Deduct:

Interest and dividend income ........................... 37 82

Other, net ....................................... 3(1) –

Operating cash flow ................................ 42,301 26,415 7,555

Deduct:

Depreciation, amortization and accretion .................... 35,271 23,643 7,571

(Gain) loss on asset disposals, net ....................... 691 2,482 28

Operating income (loss) (GAAP) ........................ $ 6,339 $ 290 $ (44)

56

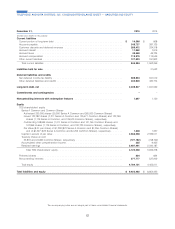

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS