US Cellular 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

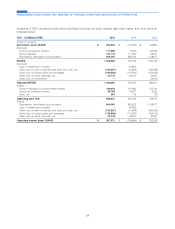

Income Taxes

The amounts of income tax assets and liabilities, the related income tax provision and the amount of unrecognized tax

benefits are critical accounting estimates because such amounts are significant to TDS’ financial condition and results of

operations.

The preparation of the consolidated financial statements requires TDS to calculate a provision for income taxes. This

process involves estimating the actual current income tax liability together with assessing temporary differences resulting

from the different treatment of items for tax purposes. These temporary differences result in deferred income tax assets

and liabilities, which are included in TDS’ Consolidated Balance Sheet. TDS must then assess the likelihood that

deferred income tax assets will be realized based on future taxable income and, to the extent management believes that

realization is not likely, establish a valuation allowance. Management’s judgment is required in determining the provision

for income taxes, deferred income tax assets and liabilities and any valuation allowance that is established for deferred

income tax assets.

TDS recognizes the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be

sustained on examination by the taxing authorities based on the technical merits of the position. The tax benefits

recognized in the financial statements from such a position are measured based on management’s judgment as to the

possible outcome that has a greater than 50% cumulative likelihood of being realized upon ultimate resolution.

See Note 4 — Income Taxes in the Notes to Consolidated Financial Statements for details regarding TDS’ income tax

provision, deferred income taxes and liabilities, valuation allowances and unrecognized tax benefits, including information

regarding estimates that impact income taxes.

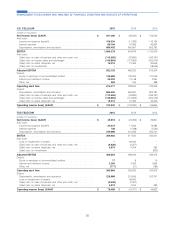

Equipment Installment Plans

TDS offers customers, through its owned and agent distribution channels, the option to purchase certain devices under

installment contracts over a specified time period and, under certain of these plans, offers the customer a trade-in right.

Customers on an installment contract who elect to trade-in the device will receive a credit in the amount of the

outstanding balance of the installment contract, provided the customer trades-in an eligible used device in good working

condition and purchases a new device from TDS. Equipment revenue under these contracts is recognized at the time

the device is delivered to the end-user customer for the selling price of the device, net of any deferred imputed interest

and the value of the trade-in right, if applicable.

Trade-In Right

TDS values the trade-in right as a guarantee liability. This liability is initially measured at fair value and is determined

based on assumptions including the probability and timing of the customer upgrading to a new device and the

estimated fair value of the used device eligible for trade-in. TDS reevaluates its estimate of the guarantee liability at each

reporting date. A significant change in any of the aforementioned assumptions used to compute the guarantee liability

would impact the amount of revenue recognized under these plans and the timing thereof. In 2015 and 2014, TDS

assumed the earliest contractual time of trade-in, or the minimum amount of payments as specified in the device

installment contract, for all customers on installment contracts with trade-in rights.

When a customer exercises the trade-in option, the difference between the outstanding receivable balance forgiven and

the fair value of the used device is recorded as a reduction to the guarantee liability. If the customer does not exercise

the trade-in option at the time he or she is eligible, TDS begins amortizing the liability and records this amortization as

additional operating revenue.

Interest

TDS equipment installment plans do not provide for explicit interest charges. For equipment installment plans with a

duration of greater than twelve months, TDS imputes interest using a market rate and recognizes such interest income

over the duration of the plan as a component of Interest and dividend income. Changes in the imputed interest rate

would impact the amount of revenue recognized under these plans.

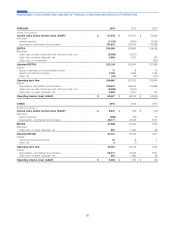

Allowance for doubtful accounts

TDS maintains an allowance for doubtful accounts for estimated losses that result from the failure of its customers to

make payments due under the equipment installment plans. The allowance is estimated based on historical experience,

account aging and other factors that could affect collectability. When it is probable that an account balance will not be

46

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS