US Cellular 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11MAR201618464745

11MAR201618465639

Throughout 2015, as discussed below, TDS primarily focused on investing in the networks that are the backbone of its

commitment to provide outstanding communications services to its customers. TDS believes these investments will

strengthen its competitive position and improve operating performance. Looking ahead to 2016, TDS will look to build

shareholder value by continuing to execute on its strategies to build strong, competitive businesses providing

high-quality, data-focused products and services.

Invest in the business to improve returns and pursue initiatives that align with long-term strategies

Consistent with its strategy, TDS made significant investments in 2015 to improve the performance of its networks. U.S.

Cellular completed the rollout of the 4G LTE network giving customers faster data speeds on an even higher-quality

wireless network. U.S. Cellular also participated in Auction 97 indirectly through its limited partnership interest in

Advantage Spectrum L.P. (‘‘Advantage Spectrum’’). Advantage Spectrum was the provisional winning bidder of 124

licenses for an aggregate bid of $338.3 million.

At TDS Telecom, the wireline segment continued its targeted fiber deployment and now offers IPTV service in 27

markets. During 2015, TDS Telecom also worked to integrate cable acquisitions and continued efforts to improve

network quality and product offerings of previously acquired cable businesses. The HMS segment opened a new data

center in Denver, CO to expand its presence in the IT outsourcing market.

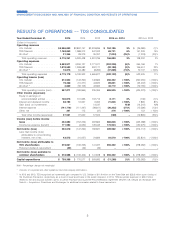

Return value to shareholders

Since August of 2013, TDS has invested $581.4 million, primarily through acquisition of cable companies and returned

$195.8 million to shareholders through payment of $147.0 million in regular quarterly cash dividends and $48.8 million of

stock repurchases. During 2015, TDS paid $61.2 million in regular quarterly cash dividends. TDS increased the dividend

paid to its investors by 5% in 2015 which marks the 41st consecutive year of dividend increases and in February 2016,

TDS increased its dividend per share from $0.141 to $0.148. There were no TDS and limited U.S. Cellular share

repurchases in 2015. There is no assurance that TDS will continue to increase the dividend rate or pay dividends and no

assurance that TDS or U.S. Cellular will make any significant amount of share repurchases in the future.

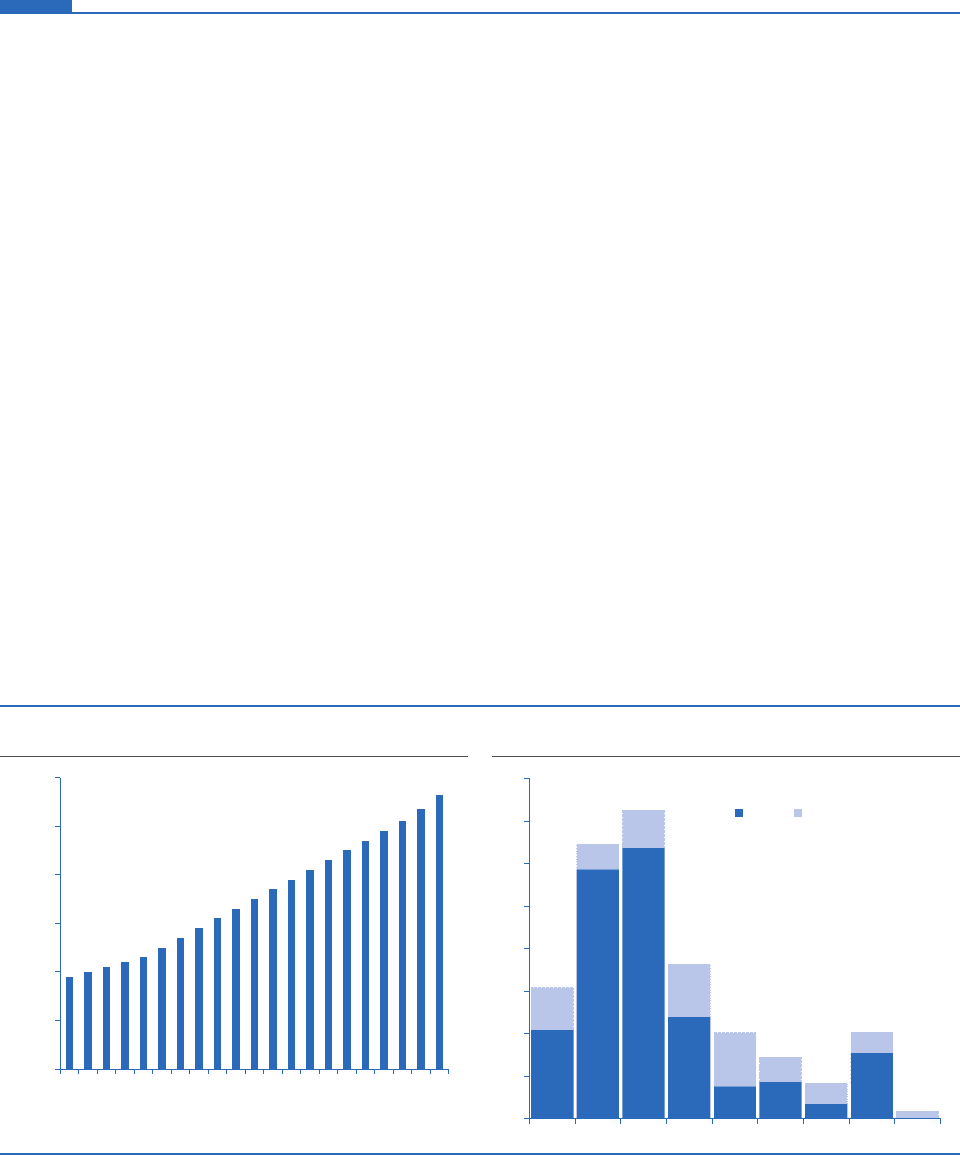

Shares Repurchased

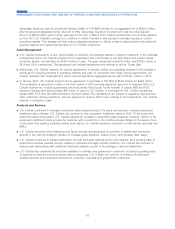

Annual Dividends Per TDS Share (Shares in millions)

$0.00

1996

1995

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

0

1

2

3

4

5

6

7

8

2007 2008 2009 2010 2011 2012 2013 2014 2015

TDS U.S. Cellular

Support growth initiatives through sound and disciplined financing strategies.

During 2015, U.S. Cellular sold $300 million in 7.25% senior notes and secured a $225 million term loan to fund its

operations, current and future spectrum purchases, growth in equipment installment plan receivables and capital

expenditures.

2

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS