US Cellular 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

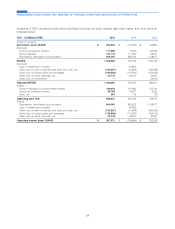

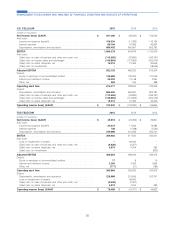

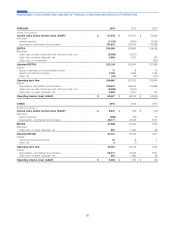

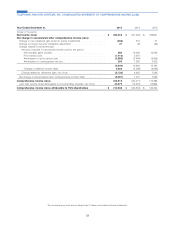

HMS 2015 2014 2013

(Dollars in thousands)

Income (loss) before income taxes (GAAP)1................ $ (17,828) $ (110,699) $ (21,664)

Add back:

Interest expense ................................... 2,329 1,602 1,626

Depreciation, amortization and accretion .................... 26,948 26,912 24,262

EBITDA ......................................... 11,449 (82,185) 4,224

Add back:

Loss on impairment of assets .......................... –84,000 –

(Gain) loss on asset disposals, net ....................... 89 181 125

Adjusted EBITDA .................................. 11,538 1,996 4,349

Deduct:

Interest and dividend income ........................... 35 26 63

Other, net ....................................... (98) 12 29

Operating cash flow ................................ 11,601 1,958 4,257

Deduct:

Depreciation, amortization and accretion .................... 26,948 26,912 24,262

Loss on impairment of assets .......................... –84,000 –

(Gain) loss on asset disposals, net ....................... 89 181 125

Operating income (loss) (GAAP) ........................ $ (15,436) $ (109,135) $ (20,130)

1Income tax expense (benefit) is not provided at the individual segment level for Wireline, Cable and HMS. TDS calculates income tax expense for TDS

Telecom in total.

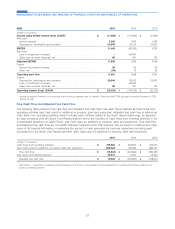

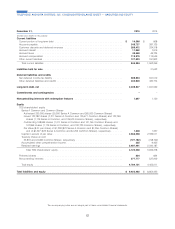

Free Cash Flow and Adjusted Free Cash Flow

The following table presents Free cash flow and Adjusted free cash flow. Free cash flow is defined as Cash flows from

operating activities less Cash used for additions to property, plant and equipment. Adjusted free cash flow is defined as

Cash flows from operating activities (which includes cash outflows related to the Sprint decommissioning), as adjusted

for cash proceeds from the Sprint Cost Reimbursement (which are included in Cash flows from investing activities in the

Consolidated Statement of Cash Flows), less Cash used for additions to property, plant and equipment. Free cash flow

and Adjusted free cash flow are non-GAAP financial measures which TDS believes may be useful to investors and other

users of its financial information in evaluating the amount of cash generated by business operations (including cash

proceeds from the Sprint Cost Reimbursement), after Cash used for additions to property, plant and equipment.

2015 2014 2013

(Dollars in thousands)

Cash flows from operating activities ........................ $ 789,694 $ 394,812 $ 494,610

Less: Cash used for additions to property, plant and equipment ...... 800,628 799,496 883,797

Free cash flow .................................... $ (10,934) $ (404,684) $ (389,187)

Add: Sprint Cost Reimbursement1......................... 29,974 71,097 10,560

Adjusted free cash flow .............................. $ 19,040 $ (333,587) $ (378,627)

1See Note 6 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information related to the

Sprint Cost Reimbursement.

57

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS