US Cellular 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

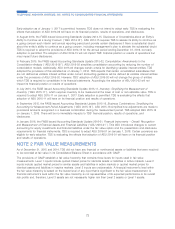

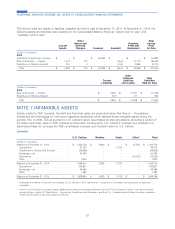

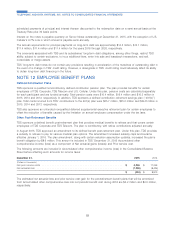

Goodwill

U.S. Cellular Wireline Cable HMS Other Total

(Dollars in thousands)

Balance at December 31, 20131. $ 232,041 $ 420,458 $ 61,712 $ 118,830 $ 3,802 $ 836,843

Acquisitions ............ – – 33,610 – – 33,610

Loss on impairment ....... – – – (84,000) (3,802) (87,802)

Divestitures ............ (291) (2,564) – – – (2,855)

Transferred to Assets held for

sale ............... (4,344) (4,100) – – – (8,444)

Balance at December 31, 2014 . 227,406 413,794 95,322 34,830 – 771,352

Divestitures ............ – (5,005) – – – (5,005)

Other ................ (555) ––––(555)

Balance at December 31, 2015 . $ 226,851 $ 408,789 $ 95,322 $ 34,830 $ – $ 765,792

1Includes accumulated impairment losses in prior periods as follows: $333.9 million for U.S. Cellular, $29.4 million for Wireline and $0.5 million for Other.

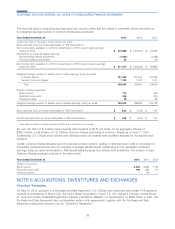

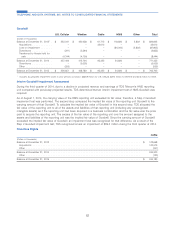

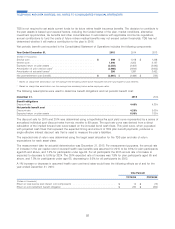

Interim Goodwill Impairment Assessment

During the third quarter of 2014, due to a decline in projected revenue and earnings of TDS Telecom’s HMS reporting

unit compared with previously projected results, TDS determined that an interim impairment test of HMS Goodwill was

required.

As of August 1, 2014, the carrying value of the HMS reporting unit exceeded its fair value; therefore, a Step 2 Goodwill

impairment test was performed. The second step compared the implied fair value of the reporting unit Goodwill to the

carrying amount of that Goodwill. To calculate the implied fair value of Goodwill in this second step, TDS allocated the

fair value of the reporting unit to all of the assets and liabilities of that reporting unit (including any unrecognized

intangible assets) as if the reporting unit had been acquired in a business combination and the fair value was the price

paid to acquire the reporting unit. The excess of the fair value of the reporting unit over the amount assigned to the

assets and liabilities of the reporting unit was the implied fair value of Goodwill. Since the carrying amount of Goodwill

exceeded the implied fair value of Goodwill, an impairment loss was recognized for that difference. As a result of the

Step 2 Goodwill impairment test, TDS recognized a loss on impairment of $84.0 million during the third quarter of 2014.

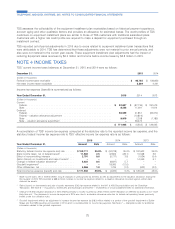

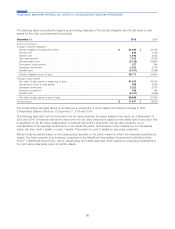

Franchise Rights

Cable

(Dollars in thousands)

Balance at December 31, 2013 ...................................................... $ 123,668

Acquisitions ................................................................. 120,979

Other ..................................................................... (347)

Balance at December 31, 2014 ...................................................... 244,300

Other ..................................................................... (120)

Balance at December 31, 2015 ...................................................... $ 244,180

82

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS