US Cellular 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12MAR201601533026

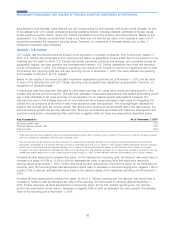

At December 31, 2015, TDS’ consolidated cash and

cash equivalents totaled $984.6 million. The majority of

TDS’ Cash and cash equivalents was held in bank

deposit accounts and in money market funds that invest

exclusively in U.S. Treasury Notes or in repurchase

agreements fully collateralized by such obligations. TDS

monitors the financial viability of the money market funds

and direct investments in which it invests and believes

that the credit risk associated with these investments is

low.

$0

$200

$400

$600

$800

$1,000

$1,200

2013 2014 2015

U.S. Cellular

TDS Telecom , TDS

Corporate & Other

Financing

Revolving Credit Facilities

TDS (exclusive of facilities held by U.S. Cellular) and U.S. Cellular have revolving credit facilities available for general

corporate purposes including spectrum purchases and capital expenditures, with a maximum borrowing capacity of

$400 million and $300 million, respectively. As of December 31, 2015, the unused capacity under these agreements was

$399.4 million and $282.5 million, respectively. Neither TDS nor U.S. Cellular borrowed or repaid any cash amounts

under their revolving credit facilities in 2015, and had no cash borrowings outstanding under their revolving credit

facilities as of December 31, 2015. The continued availability of the revolving credit facilities requires TDS and U.S.

Cellular to comply with certain negative and affirmative covenants, maintain certain financial ratios and make

representations regarding certain matters at the time of each borrowing. TDS and U.S. Cellular believe that they were in

compliance as of December 31, 2015 with all of the financial and other covenants and requirements set forth in their

revolving credit facilities.

See Note 11 — Debt in the Notes to Consolidated Financial Statements for additional information regarding the revolving

credit facilities.

Term Loan

In January 2015, U.S. Cellular entered into a senior term loan credit facility. In July 2015, U.S. Cellular borrowed the full

amount of $225 million available under this facility in two separate draws. Principal reductions will be due and payable in

quarterly installments of $2.8 million beginning in March 2016 through December 2021, and the remaining unpaid

balance will be due and payable in January 2022. This facility was entered into for general corporate purposes, including

working capital, spectrum purchases and capital expenditures.

The continued availability of the term loan facility requires U.S. Cellular to comply with certain negative and affirmative

covenants, maintain certain financial ratios and make representations regarding certain matters at the time of each

borrowing, that are substantially the same as those in the U.S. Cellular revolving credit facility described above. TDS

believes that U.S. Cellular was in compliance at December 31, 2015 with all of the financial and other covenants and

requirements set forth in the term loan facility.

See Note 11 — Debt in the Notes to Consolidated Financial Statements for additional information.

Financial Covenants

As noted above, The TDS and U.S. Cellular revolving credit facilities and the U.S. Cellular senior term loan facility require

TDS or U.S. Cellular, as applicable, to comply with certain affirmative and negative covenants, including certain financial

covenants. In particular, under these agreements, as amended, beginning July 1, 2014, TDS and U.S. Cellular are

required to maintain the Consolidated Leverage Ratio at a level not to exceed 3.75 to 1.00 for the period of the four

fiscal quarters most recently ended (this was 3.00 to 1.00 prior to July 1, 2014). The maximum permitted Consolidated

33

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

TDS Cash and Cash Equivalents

(Dollars in millions)