US Cellular 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

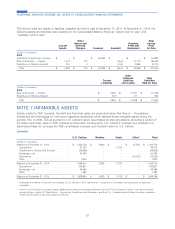

TDS assesses the collectability of the equipment installment plan receivables based on historical payment experience,

account aging and other qualitative factors and provides an allowance for estimated losses. The credit profiles of TDS

customers on equipment installment plans are similar to those of TDS customers with traditional subsidized plans.

Customers with a higher risk credit profile are required to make a deposit for equipment purchased through an

installment contract.

TDS recorded out-of-period adjustments in 2015 due to errors related to equipment installment plan transactions that

were attributable to 2014. TDS has determined that these adjustments were not material to prior annual periods, and

also were not material to the current year results. These equipment installment plan adjustments had the impact of

reducing Equipment sales revenues by $6.2 million and Income before income taxes by $5.8 million in 2015.

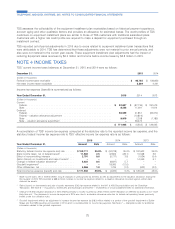

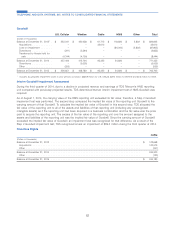

NOTE 4 INCOME TAXES

TDS’ current income taxes balances at December 31, 2015 and 2014 were as follows:

December 31, 2015 2014

(Dollars in thousands)

Federal income taxes receivable .............................................. $ 66,785 $ 108,820

Net state income taxes receivable ............................................. 3,309 4,391

Income tax expense (benefit) is summarized as follows:

Year Ended December 31, 2015 2014 2013

(Dollars in thousands)

Current

Federal ................................................... $ 92,887 $ (87,736) $ 181,579

State .................................................... 8,256 11,091 11,614

Deferred

Federal ................................................... 60,939 41,851 (65,970)

Federal – valuation allowance adjustment ............................. –(10,816) –

State .................................................... 9,910 2,208 (1,180)

State – valuation allowance adjustment ............................... –38,470 –

$ 171,992 $ (4,932) $ 126,043

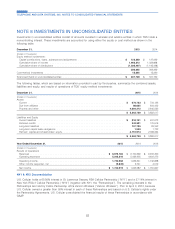

A reconciliation of TDS’ income tax expense computed at the statutory rate to the reported income tax expense, and the

statutory federal income tax expense rate to TDS’ effective income tax expense rate is as follows:

2015 2014 2013

Year Ended December 31, Amount Rate Amount Rate Amount Rate

(Dollars in thousands)

Statutory federal income tax expense and rate ..... $ 152,111 35.0% $ (53,278) 35.0% $ 102,502 35.0%

State income taxes, net of federal benefit1........ 11,002 2.5 42,834 (28.1) 10,548 3.6

Effect of noncontrolling interests .............. 2,791 0.6 (5,777) 3.8 (1,034) (0.4)

Gains (losses) on investments and sale of assets2... –– – – 14,949 5.1

Change in federal valuation allowance3.......... 2,022 0.5 (8,697) 5.7 – –

Goodwill impairment4..................... ––18,260 (12.0) – –

Other differences, net ..................... 4,066 1.0 1,726 (1.2) (922) (0.3)

Total income tax expense (benefit) and rate ....... $ 171,992 39.6% $ (4,932) 3.2% $ 126,043 43.0%

1State income taxes, net of federal benefit, include changes in unrecognized tax benefits as well as adjustments to the valuation allowance. During the

third quarter of 2014 TDS recorded a $38.5 million increase to income tax expense related to a valuation allowance recorded against certain state

deferred tax assets.

2Gains (losses) on investments and sale of assets represents 2013 tax expense related to the NY1 & NY2 Deconsolidation and the Divestiture

Transaction. See Note 6 — Acquisitions, Divestitures and Exchanges and Note 8 — Investments in Unconsolidated Entities for additional information.

3Change in federal valuation allowance in 2015 relates primarily to losses incurred by certain entities where realization of deferred tax assets is not ‘‘more

likely than not.’’ The decrease to income tax expense in 2014 was due to a valuation allowance reduction for federal net operating losses previously

limited under loss utilization rules.

4Goodwill impairment reflects an adjustment to increase income tax expense by $18.3 million related to a portion of the goodwill impairment of Suttle-

Straus and the HMS reporting unit recorded in 2014 which is nondeductible for income tax purposes. See Note 7 — Intangible Assets for additional

information related to the goodwill impairment.

75

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS