US Cellular 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30MAR201620541628

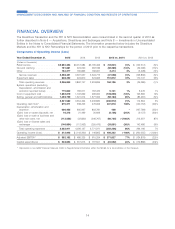

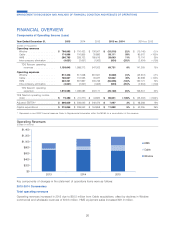

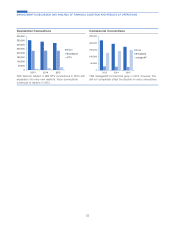

Service revenues consist of:

ᔢCharges for access, airtime, roaming, recovery of regulatory

costs and value added services, including data products

and services (‘‘retail service’’)

ᔢCharges to other wireless carriers whose customers use

U.S. Cellular’s wireless systems when roaming

ᔢAmounts received from the Federal USF

ᔢTower rental revenues

Equipment revenues consist of:

ᔢSales of wireless devices and related accessories to new

and existing customers, agents, and third-party distributors

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

2013 2014 2015

Equipment

Other

Service

Inbound

Roaming

Retail

Service

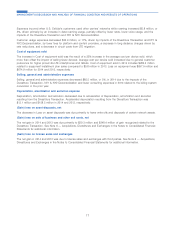

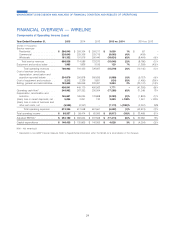

Key components of changes in the statement of operations line items were as follows:

2015-2014 Commentary

Total operating revenues

Service revenues decreased as a result of (i) a decrease in retail service revenues driven by industry-wide price

competition, including discounts on shared data plans provided to customers on equipment installment plans and those

providing their own device at the time of activation or renewal; and (ii) reductions in inbound roaming revenue driven by

lower roaming rates. Such reductions were partially offset by an increase in the average customer base, continued

adoption of shared data plans, and the $58.2 million of revenue recognized in 2015 from unredeemed rewards points

upon termination of U.S. Cellular’s rewards program.

Revenue representing amounts received from the Federal USF for the year ended December 31, 2015 was $92.1 million,

which remained flat year over year. Pursuant to the FCC’s Reform Order (‘‘Reform Order’’), U.S. Cellular’s current Federal

USF support is being phased down at the rate of 20% per year beginning July 1, 2012. The Phase II Mobility Fund was

not operational as of July 2014 and, therefore, as provided by the Reform Order, the phase down was suspended at

60% of the baseline amount. U.S. Cellular will continue to receive USF support at the 60% level until the FCC takes

further action. At this time, U.S. Cellular cannot predict what changes that the FCC might make to the USF high cost

support program and, accordingly, cannot predict whether such changes will have a material adverse effect on U.S.

Cellular’s business, financial condition or results of operations.

Equipment sales revenues increased due primarily to an increase in average revenue per device sold driven by sales

under equipment installment plans, a mix shift to smartphones and connected devices and an increase in accessory

sales, partially offset by a decrease in the number of devices sold. Equipment installment plan sales contributed

$350.7 million and $190.4 million in 2015 and 2014, respectively.

System operations expenses

Maintenance, utility and cell site expenses increased $13.3 million, or 4%, reflecting higher support costs and utility

usage for the expanded 4G LTE network and the completion of certain tower maintenance and repair projects.

Expenses incurred when U.S. Cellular’s customers used other carriers’ networks while roaming increased $19.4 million,

or 11%, driven primarily by an increase in data roaming usage, partially offset by lower rates and voice volume.

15

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Total Operating Revenues

(Dollars in millions)