US Cellular 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

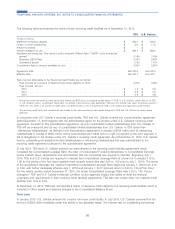

assets in certain markets in Wisconsin, Iowa, Minnesota and Michigan, to U.S. Cellular for $91.5 million in cash (the

‘‘Airadigm Transaction’’). Since both parties to this transaction are controlled by TDS, upon closing, U.S. Cellular

recorded the transferred assets at Airadigm’s net book value of $15.2 million.

ᔢIn March 2014, U.S. Cellular sold the majority of its St. Louis area non-operating market spectrum license for

$92.3 million. A gain of $75.8 million was recorded in (Gain) loss on license sales and exchanges in the Consolidated

Statement of Operations in the first quarter of 2014.

ᔢIn February 2014, U.S. Cellular completed an exchange whereby U.S. Cellular received one E block PCS spectrum

license covering Milwaukee, WI in exchange for one D block PCS spectrum license covering Milwaukee, WI. The

exchange of licenses provided U.S. Cellular with spectrum to meet anticipated future capacity and coverage

requirements. No cash, customers, network assets, other assets or liabilities were included in the exchange. As a

result of this transaction, TDS recognized a gain of $15.7 million, representing the difference between the $15.9 million

fair value of the license surrendered, calculated using a market approach valuation method, and the $0.2 million

carrying value of the license surrendered. This gain was recorded in (Gain) loss on license sales and exchanges in the

Consolidated Statement of Operations in the first quarter of 2014.

ᔢIn October 2013, TDS acquired 100% of the outstanding shares of MSN Communications, Inc. (‘‘MSN’’) for

$43.6 million in cash. MSN is an information technology solutions provider whose service offerings complement the

HMS portfolio of products. MSN is included in the HMS segment for reporting purposes.

ᔢIn October 2013, U.S. Cellular sold the majority of its Mississippi Valley non-operating market license (‘‘unbuilt

license’’) for $308.0 million. At the time of the sale, a $250.6 million gain was recorded in (Gain) loss on license sales

and exchanges in the Consolidated Statement of Operations.

ᔢIn August 2013, TDS Telecom acquired substantially all of the assets of Baja Broadband, LLC (‘‘Baja’’) for

$264.1 million in cash. Baja is a cable company that operates in markets primarily in Colorado, New Mexico, Texas,

and Utah and offers broadband, video and voice services, which complement the TDS Telecom portfolio of products.

Baja is included in the Cable segment for reporting purposes.

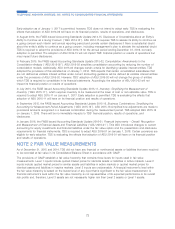

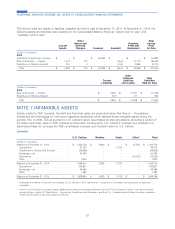

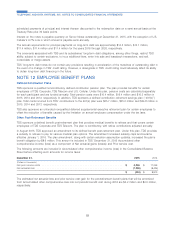

TDS’ acquisitions in 2015 and 2014 and the allocation of the purchase price for these acquisitions were as follows:

Allocation of Purchase Price

Intangible

Purchase Franchise Assets Subject Net Tangible

Price1Goodwill2Licenses Rights to Amortization3Assets/(Liabilities)

(Dollars in thousands)

2015

U.S. Cellular licenses4...... $ 345,807 $ – $ 345,807 $ – $ – $ –

Total ............... $ 345,807 $ – $ 345,807 $ – $ – $ –

2014

U.S. Cellular licenses ....... $ 41,707 $ – $ 41,707 $ – $ – $ –

TDS Telecom cable business . . 273,789 33,610 2,703 120,979 14,056 102,441

Total ............... $ 315,496 $ 33,610 $ 44,410 $ 120,979 $ 14,056 $ 102,441

1Cash amounts paid for acquisitions may differ from the purchase price due to cash acquired in the transactions and the timing of cash payments

related to the respective transactions.

2The entire amount of Goodwill acquired in 2014 was amortizable for income tax purposes.

3In 2014, at the date of acquisition, the weighted average amortization period for Intangible Assets Subject to Amortization acquired was 4.6 years for

TDS Telecom’s cable business.

4Includes purchases totaling $338.3 million made by Advantage Spectrum from the FCC for licenses in Auction 97. These licenses have not yet been

granted by the FCC.

80

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS