US Cellular 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

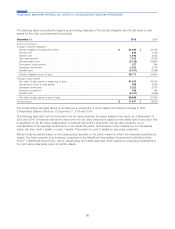

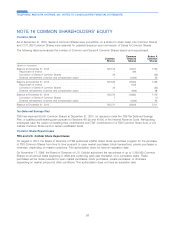

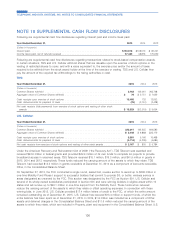

A summary of TDS nonvested restricted stock units and changes during 2015, is presented in the table below:

Weighted

Average

Grant Date

Common Restricted Stock Units Number Fair Value

Nonvested at December 31, 2014 ...................................... 692,000 $ 23.20

Granted ..................................................... 368,000 $ 27.57

Forfeited ..................................................... (16,000) $ 25.60

Nonvested at December 31, 2015 ...................................... 1,044,000 $ 24.70

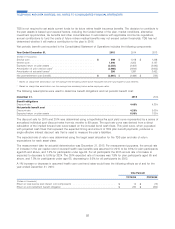

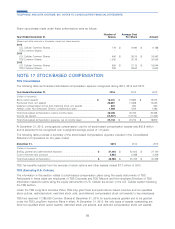

No restricted stock units vested during 2015. The total fair values as of the respective vesting dates of restricted stock

units vested during 2014 and 2013 were $7.5 million and $5.8 million, respectively. The weighted average grant date fair

value per share of the restricted stock units granted in 2015, 2014 and 2013 was $27.57, $25.26 and $21.09,

respectively.

Long-Term Incentive Plans – Deferred Compensation Stock Units – Certain TDS employees may elect to defer receipt of

all or a portion of their annual bonuses and to receive a company matching contribution on the amount deferred. All

bonus compensation that is deferred by employees electing to participate is immediately vested and is deemed to be

invested in TDS Common Share units. The amount of TDS’ matching contribution depends on the portion of the annual

bonus that is deferred. Participants receive a 25% stock unit match for amounts deferred up to 50% of their total annual

bonus and a 33% match for amounts that exceed 50% of their total annual bonus; such matching contributions also are

deemed to be invested in TDS Common Share units.

The total fair values of deferred compensation stock units that vested during 2015, 2014 and 2013 were $0.1 million,

$0.1 million and $0.1 million, respectively. The weighted average grant date fair value per share of the deferred

compensation stock units granted in 2015, 2014 and 2013 was $25.36, $23.27 and $21.99, respectively. As of

December 31, 2015, there were 261,000 vested but unissued deferred compensation stock units valued at $6.8 million.

Compensation of Non-Employee Directors – TDS issued 28,000, 33,000 and 33,000 Common Shares under its

Non-Employee Director plan in 2015, 2014 and 2013, respectively.

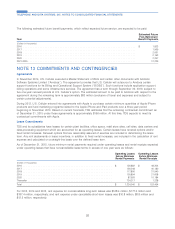

Dividend Reinvestment Plans (‘‘DRIP’’) – TDS had reserved 605,000 Common Shares at December 31, 2015, for

issuance under Automatic Dividend Reinvestment and Stock Purchase Plans and 107,000 Series A Common Shares for

issuance under the Series A Common Share Automatic Dividend Reinvestment Plan. These plans enabled holders of

TDS’ Common Shares and Preferred Shares to reinvest cash dividends in Common Shares and holders of Series A

Common Shares to reinvest cash dividends in Series A Common Shares. The purchase price of the shares is 95% of

the market value, based on the average of the daily high and low sales prices for TDS’ Common Shares on the New

York Stock Exchange for the ten trading days preceding the date on which the purchase is made. These plans are

considered non-compensatory plans; therefore no compensation expense is recognized for stock issued under these

plans.

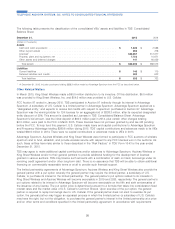

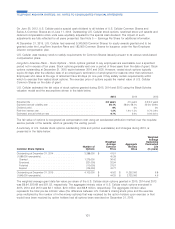

U.S. Cellular

The information in this section relates to stock-based compensation plans using the equity instruments of U.S. Cellular.

Participants in these plans are employees of U.S. Cellular and Non-employee Directors of U.S. Cellular. Information

related to plans using the equity instruments of TDS are shown in the previous section.

U.S. Cellular has established the following stock-based compensation plans: Long-Term Incentive Plans and a

Non-Employee Director compensation plan.

Under the U.S. Cellular Long-Term Incentive Plans, U.S. Cellular may grant fixed and performance based incentive and

non-qualified stock options, restricted stock, restricted stock units, and deferred compensation stock unit awards to key

employees. At December 31, 2015, the only types of awards outstanding are fixed non-qualified stock option awards,

restricted stock unit awards, and deferred compensation stock unit awards.

Under the Non-Employee Director compensation plan, U.S. Cellular may grant Common Shares to members of the

Board of Directors who are not employees of U.S. Cellular or TDS.

100

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS