US Cellular 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Significant Financial and Operating Matters

The following is a summary of certain selected information contained in the comprehensive MD&A that follows. The

overview does not contain all of the information that may be important. You should carefully read the entire MD&A and

not rely solely on the highlights.

ᔢNet income attributable to TDS shareholders was $219.0 million in 2015, compared to a net loss of $136.4 million in

2014. The year-over-year improvement was attributable to several factors including (i) increased equipment revenues

bolstered by equipment installment plan activity; (ii) reduced cost of equipment sold due to fewer wireless equipment

sales transactions overall and lower cost per wireless unit sold; (iii) reduced selling, general and administrative

expenses; (iv) increased gains from sales and exchanges of businesses and licenses; and (v) non-cash losses on

impairment in 2014. Diluted earnings per share was $1.98 compared to a diluted loss per share of $1.26 one year

ago.

ᔢIn March 2015, U.S. Cellular announced that it would discontinue its loyalty reward program effective September 1,

2015. All unredeemed reward points expired at that time and the deferred revenue balance related to such expired

points was recognized as service revenues. The amount of deferred revenue recognized upon discontinuation of this

program was $58.2 million.

ᔢU.S. Cellular completed license exchanges and the sale of towers outside of its operating markets. See Note 6 —

Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information

related to these transactions.

ᔢTotal additions to Property, plant and equipment were $759.4 million, including expenditures to complete the network

rollout of 4G LTE, construct cell sites, increase capacity in existing cell sites and switches, outfit new and remodel

existing retail stores, enhance billing and other customer management related systems and platforms, perform network

upgrades and fiber expansion, and expand HMS data center facilities.

Terms Used by TDS

All defined terms in this MD&A are used as defined in the Notes to Consolidated Financial Statements, and additional

terms are defined below:

ᔢ4G LTE – fourth generation Long-Term Evolution which is a wireless broadband technology.

ᔢAuction 97 – An FCC auction of AWS-3 spectrum licenses that ended in January 2015.

ᔢAverage Billings per Account (‘‘ABPA’’) – metric is calculated by dividing total postpaid service revenues plus

equipment installment plan billings by the average number of postpaid accounts by the number of months in the

period.

ᔢAverage Billings per User (‘‘ABPU’’) – metric is calculated by dividing total postpaid service revenues plus

equipment installment plan billings by the average number of postpaid customers by the number of months in the

period.

ᔢAverage Revenue per Account (‘‘ARPA’’) – metric is calculated by dividing total postpaid service revenues by the

average number of postpaid accounts by the number of months in the period.

ᔢAverage Revenue per User (‘‘ARPU’’) – metric is calculated by dividing a revenue base by an average number of

customers by the number of months in the period. These revenue bases and customer populations are shown below:

ᔢPostpaid ARPU – consists of total postpaid service revenues and postpaid customers.

ᔢService Revenue ARPU – consists of total postpaid, prepaid and reseller service revenues, inbound roaming and

other service revenues and postpaid, prepaid and reseller customers.

ᔢBroadband Connections – refers to the number of Wireline customers provided high-capacity data circuits via

various technologies, including DSL and dedicated internet circuit technologies or the Cable billable number of lines

into a building for high-speed data services.

ᔢChurn Rate – represents the percentage of the customers that disconnect service each month. These rates represent

the average monthly churn rate for each respective period.

3

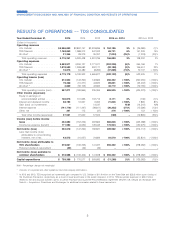

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS