US Cellular 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

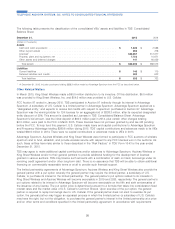

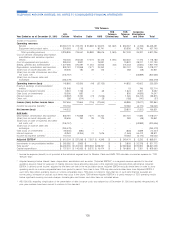

TDS Telecom

TDS TDS Corporate,

U.S. Telecom Telecom Eliminations

Year Ended or as of December 31, 2013 Cellular Wireline Cable HMS Eliminations Total and Other Total

(Dollars in thousands)

Operating revenues

Service ....................$3,594,773 $ 723,372 $ 35,883 $ 94,875 $(1,063) $ 853,067 $ (4,349) $4,443,491

Equipment and product sales ....... 324,063 3,195 – 90,741 – 93,936 39,746 457,745

Total operating revenues ........ 3,918,836 726,567 35,883 185,616 (1,063) 947,003 35,397 4,901,236

Cost of services (excluding Depreciation,

amortization and accretion reported

below) ..................... 763,435 266,635 17,274 60,423 (1,000) 343,332 11,416 1,118,183

Cost of equipment and products ...... 999,000 3,831 – 75,991 – 79,822 28,311 1,107,133

Selling, general and administrative ..... 1,677,395 220,097 11,054 44,945 (63) 276,033 (5,650) 1,947,778

Depreciation, amortization and accretion . . 803,781 170,868 7,571 24,262 – 202,701 11,595 1,018,077

(Gain) loss on asset disposals, net ..... 30,606 130 28 125 – 283 (48) 30,841

(Gain) loss on sale of business and other

exit costs, net ................ (246,767) – – – – – (53,889) (300,656)

(Gain) loss on license sales and

exchanges .................. (255,479) – – – – – – (255,479)

Operating income (loss) .......... 146,865 65,006 (44) (20,130) – 44,832 43,662 235,359

Equity in earnings of unconsolidated

entities .................... 131,949 19 – – – 19 746 132,714

Interest and dividend income ........ 3,961 1,759 2 63 – 1,824 3,307 9,092

Gain (loss) on investments.......... 18,556 830 – – – 830 (4,839) 14,547

Interest expense ................ (43,963) 3,265 (74) (1,626) – 1,565 (56,413) (98,811)

Other, net .................... 288 (214) – 29 – (185) (140) (37)

Income (loss) before income taxes . . . 257,656 70,665 (116) (21,664) – 48,885 (13,677) 292,864

Income tax expense (benefit)1........ 113,134 19,084 (6,175) 126,043

Net income (loss) .............. 144,522 29,801 (7,502) 166,821

Add back:

Depreciation, amortization and accretion . . 803,781 170,868 7,571 24,262 – 202,701 11,595 1,018,077

(Gain) loss on asset disposals, net ..... 30,606 130 28 125 – 283 (48) 30,841

(Gain) loss on sale of business and other

exit costs, net ................ (246,767) – – – – – (53,889) (300,656)

(Gain) loss on license sales and

exchanges .................. (255,479) – – – – – – (255,479)

Gain (loss) on investments.......... (18,556) (830) – – – (830) 4,839 (14,547)

Interest expense ................ 43,963 (3,265) 74 1,626 – (1,565) 56,413 98,811

Income tax expense (benefit)1........ 113,134 19,084 (6,175) 126,043

Adjusted EBITDA2..............$ 615,204 $ 237,568 $ 7,557 $ 4,349 $ – $ 249,474 $ 5,233 $ 869,911

Investments in unconsolidated entities . . . $ 265,585 $ 3,809 $ – $ – $ – $ 3,809 $ 32,378 $ 301,772

Total assets3..................$6,430,255 $1,452,502 $278,969 $328,397 $ – $2,059,868 $370,905 $8,861,028

Capital expenditures ..............$ 737,501 $ 140,009 $ 8,375 $ 16,474 $ – $ 164,858 $ 7,301 $ 909,660

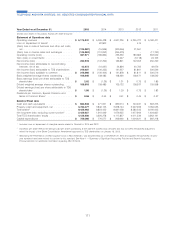

1Income tax expense (benefit) is not provided at the individual segment level for Wireline, Cable and HMS. TDS calculates income tax expense for ‘‘TDS

Telecom Total’’.

2Adjusted earnings before interest, taxes, depreciation, amortization and accretion (‘‘Adjusted EBITDA’’) is a segment measure reported to the chief

operating decision maker for purposes of making decisions about allocating resources to the segments and assessing their performance. Adjusted

EBITDA is defined as net income, adjusted for the items set forth in the reconciliation above. Adjusted EBITDA excludes these items in order to show

operating results on a more comparable basis from period to period. From time to time, TDS may also exclude other items from Adjusted EBITDA if

such items help reflect operating results on a more comparable basis. TDS does not intend to imply that any of such items that are excluded are

non-recurring, infrequent or unusual; such items may occur in the future. TDS believes Adjusted EBITDA is a useful measure of TDS’ operating results

before significant recurring non-cash charges, discrete gains and losses, and other items as indicated above.

3ASU 2015-03, regarding simplification of the presentation of debt issuance costs, was adopted as of December 31, 2015 and applied retrospectively. All

prior year numbers have been revised to conform to this standard.

105

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS