US Cellular 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

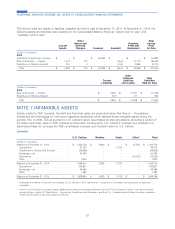

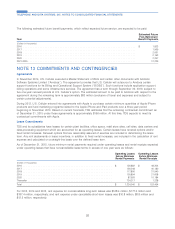

leasing arrangements. Pursuant to the terms of the permits, easements, or leasing arrangements, TDS Telecom is often

required to remove these assets and return the property to its original condition at some defined date in the future.

Asset retirement obligations are included in Other deferred liabilities and credits and Other current liabilities in the

Consolidated Balance Sheet.

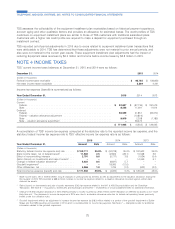

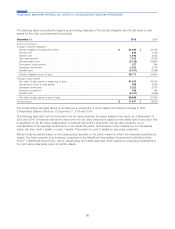

In 2015 and 2014, U.S. Cellular and TDS Telecom performed a review of the assumptions and estimated costs related to

asset retirement obligations. The results of the reviews (identified as ‘‘Revisions in estimated cash outflows’’) and other

changes in asset retirement obligations during 2015 and 2014 were as follows:

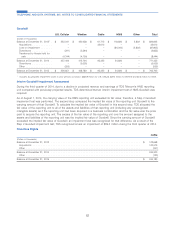

2015 2014

(Dollars in thousands)

Balance at beginning of year ............................................. $ 239,032 $ 275,238

Additional liabilities accrued ............................................. 1,661 4,907

Revisions in estimated cash outflows ....................................... (3,669) (992)

Disposition of assets ................................................. (9,684) (46,242)

Accretion expense .................................................. 15,735 17,506

Transferred to Liabilities held for sale ....................................... –(11,385)

Balance at end of year1................................................. $ 243,075 $ 239,032

1The total amount of asset retirement obligations related to the Divestiture Transaction and Airadigm Transaction included in Other current liabilities was

$9.1 million as of December 31, 2014.

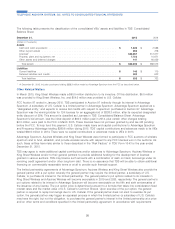

NOTE 11 DEBT

Revolving Credit Facilities

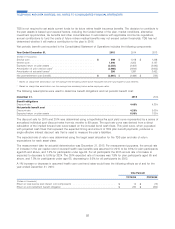

At December 31, 2015, TDS and U.S. Cellular had revolving credit facilities available for general corporate purposes.

Amounts under the revolving credit facilities may be borrowed, repaid and reborrowed from time to time until maturity.

U.S. Cellular borrowed and repaid cash amounts under its revolving credit facility in 2014. Neither TDS nor U.S. Cellular

borrowed under their revolving credit facilities in 2015 or 2013 except for standby letters of credit.

In certain circumstances, TDS’ and U.S. Cellular’s interest cost on their revolving credit facilities may be subject to

increase if their current credit ratings from nationally recognized credit rating agencies are lowered, and may be subject

to decrease if the ratings are raised.

In 2014, certain nationally recognized credit rating agencies downgraded TDS and U.S. Cellular corporate and senior

debt credit ratings. After these downgrades, TDS and U.S. Cellular are rated at sub-investment grade. As a result of

these downgrades, the commitment fee on the revolving credit facilities increased to 0.30% per annum. The downgrades

also increased the interest rate on any borrowings under the revolving credit facilities by 0.25% per annum. As of

December 31, 2015, TDS’ and U.S. Cellular’s credit ratings from the nationally recognized credit rating agencies

remained at sub-investment grade. The revolving credit facilities do not cease to be available nor do the maturity dates

accelerate solely as a result of a downgrade in TDS’ or U.S. Cellular’s credit rating. However, downgrades in TDS’ or

U.S. Cellular’s credit rating could adversely affect their ability to renew the revolving credit facilities or obtain access to

other credit facilities in the future.

The maturity date of any borrowings under the TDS and U.S. Cellular revolving credit facilities would accelerate in the

event of a change in control.

The continued availability of the revolving credit facilities requires TDS and U.S. Cellular to comply with certain negative

and affirmative covenants, maintain certain financial ratios and make representations regarding certain matters at the

time of each borrowing. TDS and U.S. Cellular believe they were in compliance as of December 31, 2015 with all

covenants and other requirements set forth in the revolving credit facilities.

85

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS