US Cellular 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

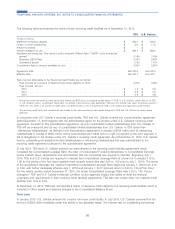

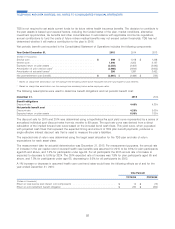

will be reset at three and six month intervals at a rate of LIBOR plus 250 basis points. This credit facility provides for the

draws to be continued on a long-term basis under terms that are readily determinable. U.S. Cellular has the ability and

intent to carry the debt for the duration of the agreement. Principal reductions will be due and payable in quarterly

installments of $2.8 million beginning in March 2016 through December 2021, and the remaining unpaid balance will be

due and payable in January 2022. This facility was entered into for general corporate purposes, including working

capital, spectrum purchases and capital expenditures.

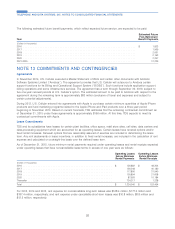

The continued availability of the term loan facility requires U.S. Cellular to comply with certain negative and affirmative

covenants, maintain certain financial ratios and make representations regarding certain matters at the time of each

borrowing, that are substantially the same as those in the U.S. Cellular revolving credit facility described above.

In connection with U.S. Cellular’s term loan credit facility, TDS and U.S. Cellular entered into a subordination agreement

dated January 21, 2015 together with the administrative agent for the lenders under U.S. Cellular’s term loan credit

agreement, which is substantially the same as the subordination agreement in the U.S. Cellular revolving credit facility

described above. As of December 31, 2015, U.S. Cellular had no outstanding consolidated funded indebtedness or

refinancing indebtedness that was subordinated to the term loan facility pursuant to this subordination agreement.

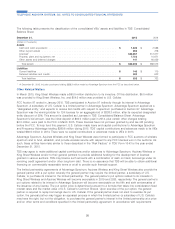

Other Long-Term Debt

In November 2015, U.S. Cellular issued $300 million of 7.25% Senior Notes due 2064, and received cash proceeds of

$289.7 million after payment of debt issuance costs of $10.3 million. These funds will be used for general corporate

purposes, including working capital, spectrum purchases and capital expenditures.

87

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS