US Cellular 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

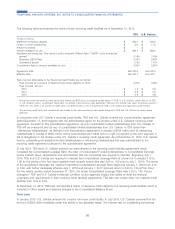

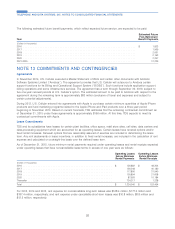

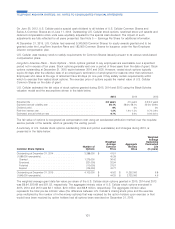

The following table presents the classification of the consolidated VIEs’ assets and liabilities in TDS’ Consolidated

Balance Sheet.

December 31, 2015 2014

(Dollars in thousands)

Assets

Cash and cash equivalents ......................................... $ 1,435 $ 2,588

Other current assets ............................................. 265 278

Licenses1.................................................... 648,661 312,977

Property, plant and equipment, net .................................... 7,722 10,671

Other assets and deferred charges .................................... 147 60,059

Total assets ................................................. $ 658,230 $ 386,573

Liabilities

Current liabilities ................................................ $ 143 $ 110

Deferred liabilities and credits ........................................ 489 622

Total liabilities ................................................ $ 632 $ 732

1At December 31, 2015, includes purchases totaling $338.3 million made by Advantage Spectrum from the FCC as described below.

Other Related Matters

In March 2015, King Street Wireless made a $60.0 million distribution to its investors. Of this distribution, $6.0 million

was provided to King Street Wireless, Inc. and $54.0 million was provided to U.S. Cellular.

FCC Auction 97 ended in January 2015. TDS participated in Auction 97 indirectly through its interest in Advantage

Spectrum. A subsidiary of U.S. Cellular is a limited partner in Advantage Spectrum. Advantage Spectrum applied as a

‘‘designated entity,’’ and expects to receive bid credits with respect to spectrum purchased in Auction 97. Advantage

Spectrum was the winning bidder for 124 licenses for an aggregate bid of $338.3 million, after its expected designated

entity discount of 25%. This amount is classified as Licenses in TDS’ Consolidated Balance Sheet. Advantage

Spectrum’s bid amount, less the initial deposit of $60.0 million paid in 2014, plus certain other charges totaling

$2.3 million, were paid to the FCC in March 2015. These licenses have not yet been granted by and are still pending

before the FCC. To help fund this payment, U.S. Cellular made loans and capital contributions to Advantage Spectrum

and Frequency Advantage totaling $280.6 million during 2015. TDS’ capital contributions and advances made to its VIEs

totaled $60.9 million in 2014. There were no capital contributions or advances made to VIEs in 2013.

Advantage Spectrum, Aquinas Wireless and King Street Wireless were formed to participate in FCC auctions of wireless

spectrum and to fund, establish, and provide wireless service with respect to any FCC licenses won in the auctions. As

such, these entities have risks similar to those described in the ‘‘Risk Factors’’ in TDS’ Form 10-K for the year ended

December 31, 2015.

TDS may agree to make additional capital contributions and/or advances to Advantage Spectrum, Aquinas Wireless or

King Street Wireless and/or to their general partners to provide additional funding for the development of licenses

granted in various auctions. TDS may finance such amounts with a combination of cash on hand, borrowings under its

revolving credit agreement and/or other long-term debt. There is no assurance that TDS will be able to obtain additional

financing on commercially reasonable terms or at all to provide such financial support.

The limited partnership agreements of Advantage Spectrum, Aquinas Wireless and King Street Wireless also provide the

general partner with a put option whereby the general partner may require the limited partner, a subsidiary of U.S.

Cellular, to purchase its interest in the limited partnership. The general partner’s put options related to its interests in

King Street Wireless and Aquinas Wireless will become exercisable in 2019 and 2020, respectively. The general partner’s

put options related to its interest in Advantage Spectrum will become exercisable on the fifth and sixth anniversaries of

the issuance of any license. The put option price is determined pursuant to a formula that takes into consideration fixed

interest rates and the market value of U.S. Cellular’s Common Shares. Upon exercise of the put option, the general

partner is required to repay borrowings due to U.S. Cellular. If the general partner does not elect to exercise its put

option, the general partner may trigger an appraisal process in which the limited partner (a subsidiary of U.S. Cellular)

may have the right, but not the obligation, to purchase the general partner’s interest in the limited partnership at a price

and on other terms and conditions specified in the limited partnership agreement. In accordance with requirements

95

TELEPHONE AND DATA SYSTEMS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS