UPS 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

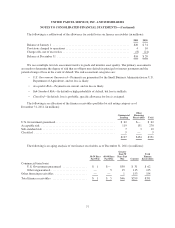

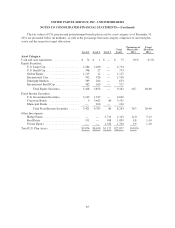

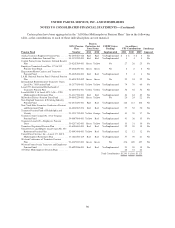

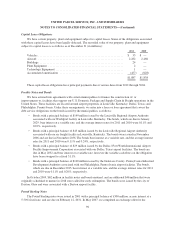

The fair values of U.S. pension and postretirement benefit plan assets by asset category as of December 31,

2010 are presented below (in millions), as well as the percentage that each category comprises of our total plan

assets and the respective target allocations.

Level 1 Level 2 Level 3

Total

Assets

Percentage of

Plan Assets -

2010

Target

Allocation

2010

Asset Category:

Cash and cash equivalents ................. $ — $ 579 $ — $ 579 2.9% 0-5%

Equity Securities:

U.S. Large Cap ...................... 4,897 — — 4,897

U.S. Small Cap ...................... 874 — — 874

International Core ................... 1,219 920 — 2,139

Emerging Markets ................... 528 281 — 809

International Small Cap ............... 117 196 — 313

Total Equity Securities ............ 7,635 1,397 — 9,032 44.4 40-60

Fixed Income Securities:

U.S. Government Securities ............ 3,502 313 — 3,815

Corporate Bonds .................... 608 1,694 193 2,495

Mortgage-Backed Securities ........... — 50 — 50

Total Fixed Income Securities ...... 4,110 2,057 193 6,360 31.3 20-40

Other Investments:

Hedge Funds ....................... — — 2,023 2,023 10.0 5-15

Real Estate ......................... 98 135 789 1,022 5.0 1-10

Private Equity ...................... — — 1,309 1,309 6.4 1-10

Total U.S. Plan Assets .................... $11,843 $4,168 $4,314 $20,325 100.0%

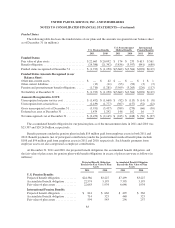

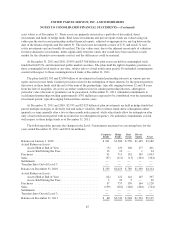

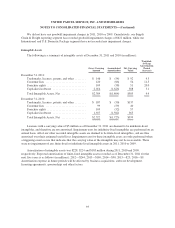

There were no UPS class A or B shares of common stock directly held in plan assets as of December 31,

2011. Equity securities include UPS class A shares of common stock in the amount of $346 million (1.7% of

total plan assets) as of December 31, 2010.

Pension assets utilizing Level 1 inputs include fair values of equity investments, corporate debt instruments,

and U.S. government securities that were determined by closing prices for those securities traded on national

stock exchanges, while securities traded in the over-the-counter market and listed securities for which no sale

was reported on the valuation date are valued at the mean between the last reported bid and asked prices.

Level 2 assets include certain bonds that are valued based on yields currently available on comparable

securities of other issues with similar credit ratings, mortgage-backed securities that are valued based on cash

flow and yield models using acceptable modeling and pricing conventions, and certain investments that are

pooled with other investments held by the trustee in a commingled employee benefit trust fund. The investments

in the commingled funds are valued by taking the percentage owned by the respective plan in the underlying net

asset value of the trust fund, which was determined in accordance with the paragraph above.

Certain investments’ estimated fair value is based on unobservable inputs that are not corroborated by

observable market data and are thus classified as Level 3. These investments include commingled funds

comprised of corporate and government bonds, hedge funds, real estate investments and private equity funds.

The commingled funds are valued using net asset values, adjusted, as appropriate, for investment fund specific

inputs determined to be significant to the valuation. Investments in hedge funds are valued using reported net

86