UPS 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

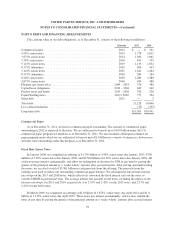

credit default swap spread, subject to a minimum rate of 0.15% and a maximum rate of 0.75%. The applicable

margin for advances bearing interest based on the base rate is 1.00% below the applicable margin for LIBOR

advances (but not lower than 0.00%). We are also able to request advances under this facility based on competitive

bids for the applicable interest rate. There were no amounts outstanding under this facility as of December 31,

2011.

The second agreement provides revolving credit facilities of $1.0 billion, and expires on April 14, 2015.

Generally, amounts outstanding under this facility bear interest at a periodic fixed rate equal to LIBOR for the

applicable interest period and currency denomination, plus an applicable margin. Alternatively, a fluctuating rate

of interest equal to Citibank’s publicly announced base rate, plus an applicable margin, may be used at our

discretion. In each case, the applicable margin for advances bearing interest based on LIBOR is a percentage

determined by quotations from Markit Group Ltd. for our credit default swap spread, interpolated for a period

from the date of determination of such credit default swap spread in connection with a new interest period until

the latest maturity date of this facility then in effect (but not less than a period of one year). The applicable

margin is subject to certain minimum rates and maximum rates based on our public debt ratings from Standard &

Poor’s Rating Service and Moody’s Investors Service. The minimum applicable margin rates range from 0.250%

to 0.500%, and the maximum applicable margin rates range from 1.000% to 1.500%. The applicable margin for

advances bearing interest based on the base rate is 1.00% below the applicable margin for LIBOR advances (but

not less than 0.00%). We are also able to request advances under this facility based on competitive bids. There

were no amounts outstanding under this facility as of December 31, 2011.

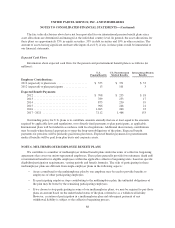

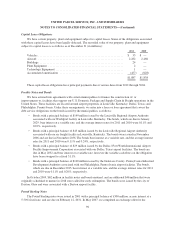

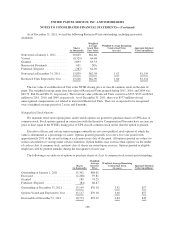

Debt Covenants

Our existing debt instruments and credit facilities do not have cross-default or ratings triggers, however

these debt instruments and credit facilities do subject us to certain financial covenants. As of December 31, 2011

and for all prior periods presented, we have satisfied these financial covenants. These covenants limit the amount

of secured indebtedness that we may incur, and limit the amount of attributable debt in sale-leaseback

transactions, to 10% of net tangible assets. As of December 31, 2011, 10% of net tangible assets is equivalent to

$2.550 billion, however we have no covered sale-leaseback transactions or secured indebtedness outstanding.

Additionally, we are required to maintain a minimum net worth, as defined, of $5.0 billion on a quarterly basis.

As of December 31, 2011, our net worth, as defined, was equivalent to $10.138 billion. We do not expect these

covenants to have a material impact on our financial condition or liquidity.

Fair Value of Debt

Based on the borrowing rates currently available to the Company for long-term debt with similar terms and

maturities, the fair value of long-term debt, including current maturities, is approximately $12.035 and $11.355

billion as of December 31, 2011 and 2010, respectively.

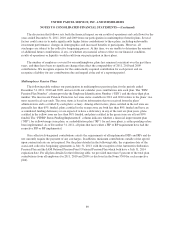

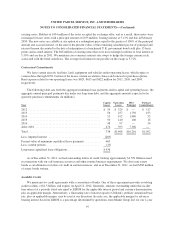

NOTE 9. LEGAL PROCEEDINGS AND CONTINGENCIES

We are involved in a number of judicial proceedings and other matters arising from the conduct of our

business activities.

Although there can be no assurance as to the ultimate outcome, we have generally denied, or believe we

have a meritorious defense and will deny, liability in all litigation pending against us, including the matters

described below, and we intend to defend vigorously each case. We have accrued for legal claims when, and to

the extent that, amounts associated with the claims become probable and can be reasonably estimated. The actual

costs of resolving legal claims may be substantially higher or lower than the amounts accrued for those claims.

98