UPS 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

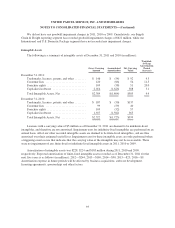

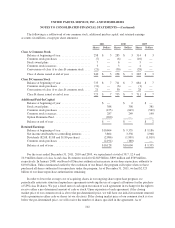

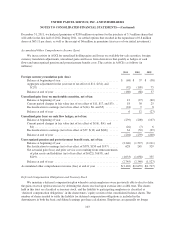

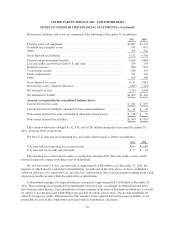

The following is a rollforward of our common stock, additional paid-in capital, and retained earnings

accounts (in millions, except per share amounts):

2011 2010 2009

Shares Dollars Shares Dollars Shares Dollars

Class A Common Stock

Balance at beginning of year .................... 258 $ 3 285 $ 3 314 $ 3

Common stock purchases ...................... (7) — (6) — (10) —

Stock award plans ............................ 7 — 6 — 5 —

Common stock issuances ....................... 3 — 3 — 4 —

Conversions of class A to class B common stock .... (21) — (30) — (28) —

Class A shares issued at end of year .............. 240 $ 3 258 $ 3 285 $ 3

Class B Common Stock

Balance at beginning of year .................... 735 $ 7 711 $ 7 684 $ 7

Common stock purchases ...................... (31) — (6) — (1) —

Conversions of class A to class B common stock .... 21 — 30 — 28 —

Class B shares issued at end of year .............. 725 $ 7 735 $ 7 711 $ 7

Additional Paid-In Capital

Balance at beginning of year .................... $ — $ 2 $ —

Stock award plans ............................ 388 398 381

Common stock purchases ...................... (475) (649) (569)

Common stock issuances ....................... 287 249 190

Option Premiums Paid ......................... (200) — —

Balance at end of year ......................... $ — $ — $ 2

Retained Earnings

Balance at beginning of year .................... $10,604 $ 9,335 $ 9,186

Net income attributable to controlling interests ..... 3,804 3,338 1,968

Dividends ($2.08, $1.88 and $1.80 per share) ....... (2,086) (1,909) (1,819)

Common stock purchases ...................... (2,194) (160) —

Balance at end of year ......................... $10,128 $10,604 $ 9,335

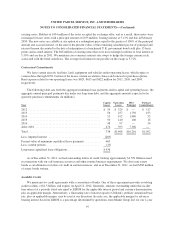

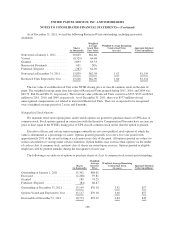

For the years ended December 31, 2011, 2010 and 2009, we repurchased a total of 38.7, 12.4 and

10.9 million shares of class A and class B common stock for $2.669 billion, $809 million and $569 million,

respectively. In January 2008, our Board of Directors authorized an increase in our share repurchase authority to

$10.0 billion. Unless terminated earlier by the resolution of our Board, the program will expire when we have

purchased all shares authorized for repurchase under the program. As of December 31, 2011, we had $2.525

billion of our share repurchase authorization remaining.

In order to lower the average cost of acquiring shares in our ongoing share repurchase program, we

periodically enter into structured repurchase agreements involving the use of capped call options for the purchase

of UPS class B shares. We pay a fixed sum of cash upon execution of each agreement in exchange for the right to

receive either a pre-determined amount of cash or stock. Upon expiration of each agreement, if the closing

market price of our common stock is above the pre-determined price, we will have our initial investment returned

with a premium in either cash or shares (at our election). If the closing market price of our common stock is at or

below the pre-determined price, we will receive the number of shares specified in the agreement. As of

102