UPS 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

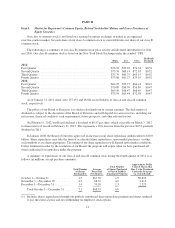

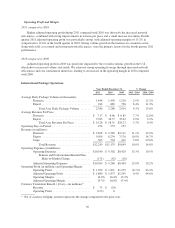

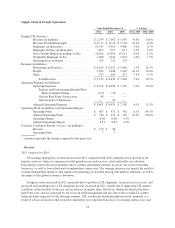

Our consolidated results are presented in the table below:

Year Ended December 31, % Change

2011 2010 2009 2011 / 2010 2010 / 2009

Revenue (in millions) ......................... $53,105 $49,545 $45,297 7.2% 9.4%

Operating Expenses (in millions) ................ 47,025 43,904 41,789 7.1% 5.1%

Operating Profit (in millions) ................... $ 6,080 $ 5,641 $ 3,508 7.8% 60.8%

Operating Margin ............................. 11.4% 11.4% 7.7%

Average Daily Package Volume (in thousands) ..... 15,797 15,574 15,064 1.4% 3.4%

Average Revenue Per Piece ..................... $ 10.82 $ 10.24 $ 9.83 5.7% 4.2%

Net Income (in millions) ....................... $ 3,804 $ 3,338 $ 1,968 14.0% 69.6%

Basic Earnings Per Share ....................... $ 3.88 $ 3.36 $ 1.97 15.5% 70.6%

Diluted Earnings Per Share ..................... $ 3.84 $ 3.33 $ 1.96 15.3% 69.9%

Items Affecting Comparability

The year-over-year comparisons of our financial results are affected by the following items (in millions):

Year Ended December 31,

2011 2010 2009

Operating Expenses:

Pension and Postretirement Benefit Plans Mark-to-Market

Charge ........................................... $827 $112 $ 16

Restructuring Charge ................................. — 98 —

Gain on Sales of Businesses ............................ — (20) —

Gains on Real Estate Transactions ....................... (33) (109) —

Aircraft Impairment Charge ............................ — — 181

Interest Expense:

Currency Remeasurement Charge ....................... — — 77

Income Tax Expense (Benefit) from the Items Above ............ (287) — (99)

Charge for Change in Tax Filing Status for German Subsidiary .... — 76 —

Pension and Postretirement Benefit Plans Mark-to-Market Charge

In 2011, 2010 and 2009, we incurred pre-tax mark-to-market losses on our pension and postretirement

benefit plans related to the remeasurement of plan assets and liabilities recognized outside of a 10% corridor of

$827, $112 and $16 million, respectively, on a consolidated basis ($527, $75 and $11 million after-tax,

respectively). These mark-to-market losses for 2011, 2010 and 2009 primarily resulted from decreases in the

discount rates used to value our projected benefit obligations in each year. These charges impacted each of our

three reporting segments in 2011 and 2010, and our International Package segment in 2009.

Restructuring Charge

In 2010, we streamlined the management structure in our U.S. Domestic Package segment, and incurred a

restructuring charge associated with this reorganization. This pre-tax charge totaled $98 million ($64 million

after-tax), and reflects the value of voluntary retirement benefits, severance benefits and unvested stock

compensation.

Gain on Sales of Businesses

In 2010, we sold our UPS Logistics Technologies business unit within our Supply Chain & Freight segment,

and recognized a pre-tax gain of $71 million ($44 million after-tax). Also in 2010, we sold a specialized

25