UPS 2011 Annual Report Download - page 38

Download and view the complete annual report

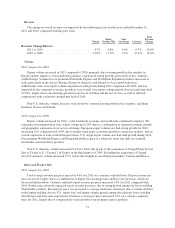

Please find page 38 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.transportation business in Germany within our Supply Chain & Freight segment, and incurred a pre-tax loss on

the sale of $51 million ($47 million after-tax), which includes a fair value adjustment loss due to a financial

guarantee associated with this business sale.

Gains on Real Estate Transactions

In 2011, we recognized a net $33 million pre-tax gain ($20 million after-tax) on a consolidated basis on

certain real estate transactions (consisting of a $48 million pre-tax gain in our Supply Chain & Freight segment,

and a $15 million pre-tax loss in our U.S. Domestic Package segment). In 2010, we recognized a pre-tax gain of

$109 million ($61 million after-tax) on the sale of real estate within our U.S. Domestic Package segment.

Aircraft Impairment Charges

In 2009, we completed an impairment assessment of our McDonnell-Douglas DC-8 aircraft fleet, and

recorded an impairment charge of $181 million ($116 million after-tax), which affected our U.S. Domestic

Package segment. This charge, as well as our accounting policies pertaining to long-lived assets, is discussed

further in “Critical Accounting Policies and Estimates”.

Currency Remeasurement Charge

During 2009, we incurred a $77 million non-cash, pre-tax currency remeasurement charge ($48 million

after-tax) on certain foreign currency denominated obligations.

Charge for Change in Tax Filing Status for German Subsidiary

In 2010, we changed the tax status of a German subsidiary that was taxable in the U.S. and its local

jurisdiction to one that is solely taxed in its local jurisdiction. As a result of this change in tax status, we recorded

a non-cash charge of $76 million to income tax expense, which resulted primarily from the write-off of related

deferred tax assets which will not be realizable following the change in tax status.

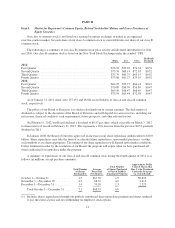

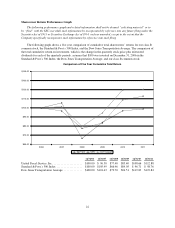

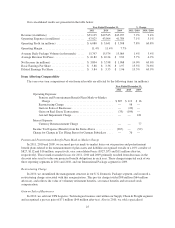

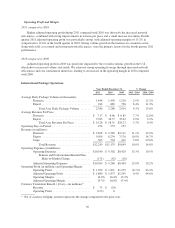

Results of Operations—Segment Review

The results and discussions that follow are reflective of how our executive management monitors the

performance of our reporting segments. We supplement the reporting of our financial information determined

under generally accepted accounting principles (“GAAP”) with certain non-GAAP financial measures, including

operating profit, operating margin, pre-tax income, net income and earnings per share adjusted for the

non-comparable items discussed previously. We believe that these adjusted measures provide meaningful

information to assist investors and analysts in understanding our financial results and assessing our prospects for

future performance. We believe these adjusted financial measures are important indicators of our recurring

results of operations because they exclude items that may not be indicative of, or are unrelated to, our core

operating results, and provide a better baseline for analyzing trends in our underlying businesses.

26