UPS 2011 Annual Report Download - page 57

Download and view the complete annual report

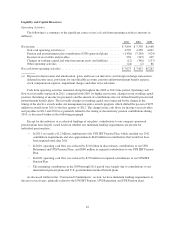

Please find page 57 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Repayments of debt in 2011, 2010 and 2009 consisted primarily of paydowns of commercial paper, early

redemptions of our UPS Notes program and certain facilities bonds, and scheduled principal payments on our

capitalized lease obligations. We consider the overall fixed and floating interest rate mix of our portfolio and the

related overall cost of borrowing when planning for future issuances and non-scheduled repayments of debt.

We had no commercial paper outstanding at December 31, 2011 and $341 million outstanding at

December 31, 2010. The amount of commercial paper outstanding fluctuates throughout each year based on daily

liquidity needs. The average commercial paper balance was $849 million and the average interest rate paid was

0.08% in 2011 ($947 million and 0.14% in 2010, respectively).

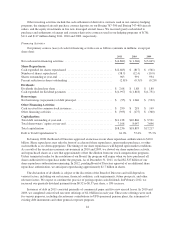

Cash received from common stock issuances to employees increased primarily due to additional stock

option exercises in 2011 and 2010. The cash outflows in other financing activities are largely due to repurchases

of shares from employees to satisfy tax withholding obligations, as well as certain hedging activities on

forecasted debt issuances and premiums paid on capped call options for the purchase of UPS class B shares. In

conjunction with the senior fixed rate debt offerings in 2010 and 2009, we settled several interest rate derivatives

that were designated as hedges of these debt offerings, which resulted in cash inflows (outflows) of $7 and

$(243) million, respectively. As of December 31, 2011, we had paid premiums of $200 million on capped call

options for the purchase of 3.3 million class B shares that will settle in the first half of 2012.

Sources of Credit

We are authorized to borrow up to $10.0 billion under our U.S. commercial paper program. As of

December 31, 2011, we had no commercial paper outstanding. The amount of commercial paper outstanding in

2012 is expected to fluctuate. We also maintain a European commercial paper program under which we are

authorized to borrow up to €1.0 billion in a variety of currencies, however no amounts were outstanding under

this program as of December 31, 2011.

We maintain two credit agreements with a consortium of banks. One of these agreements provides revolving

credit facilities of $1.5 billion, and expires on April 12, 2012. Generally, amounts outstanding under this facility

bear interest at a periodic fixed rate equal to LIBOR for the applicable interest period and currency

denomination, plus an applicable margin. Alternatively, a fluctuating rate of interest equal to Citibank’s publicly

announced base rate, plus an applicable margin, may be used at our discretion. In each case, the applicable

margin for advances bearing interest based on LIBOR is a percentage determined by quotations from Markit

Group Ltd. for our 1-year credit default swap spread, subject to a minimum rate of 0.15% and a maximum rate of

0.75%. The applicable margin for advances bearing interest based on the base rate is 1.00% below the applicable

margin for LIBOR advances (but not lower than 0.00%). We are also able to request advances under this facility

based on competitive bids for the applicable interest rate. There were no amounts outstanding under this facility

as of December 31, 2011.

The second agreement provides revolving credit facilities of $1.0 billion, and expires on April 14, 2015.

Generally, amounts outstanding under this facility bear interest at a periodic fixed rate equal to LIBOR for the

applicable interest period and currency denomination, plus an applicable margin. Alternatively, a fluctuating rate

of interest equal to Citibank’s publicly announced base rate, plus an applicable margin, may be used at our

discretion. In each case, the applicable margin for advances bearing interest based on LIBOR is a percentage

determined by quotations from Markit Group Ltd. for our credit default swap spread, interpolated for a period

from the date of determination of such credit default swap spread in connection with a new interest period until

the latest maturity date of this facility then in effect (but not less than a period of one year). The applicable

margin is subject to certain minimum rates and maximum rates based on our public debt ratings from Standard &

Poor’s Rating Service and Moody’s Investors Service. The minimum applicable margin rates range from 0.250%

to 0.500%, and the maximum applicable margin rates range from 1.000% to 1.500%. The applicable margin for

advances bearing interest based on the base rate is 1.00% below the applicable margin for LIBOR advances (but

not less than 0.00%). We are also able to request advances under this facility based on competitive bids. There

were no amounts outstanding under this facility as of December 31, 2011.

45