UPS 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

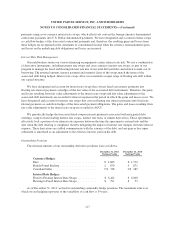

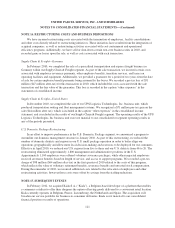

Balance Sheet Recognition

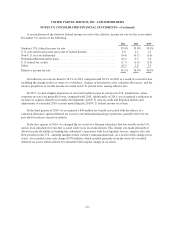

The following table indicates the location on the balance sheet in which our derivative assets and liabilities

have been recognized, and the related fair values of those derivatives (in millions). The table is segregated

between those derivative instruments that qualify and are designated as hedging instruments and those that are

not, as well as by type of contract and whether the derivative is in an asset or liability position.

Asset Derivatives Balance Sheet Location

Fair Value

Hierarchy

Level

December 31, 2011

Fair Value

December 31, 2010

Fair Value

Derivatives designated as hedges:

Foreign exchange contracts ........ Other current assets Level 2 $164 $ 36

Interest rate contracts ............. Other non-current assets Level 2 401 182

Derivatives not designated as

hedges:

Foreign exchange contracts ........ Other current assets Level 2 2 —

Interest rate contracts ............. Other non-current assets Level 2 82 —

Total Asset Derivatives ....... $649 $218

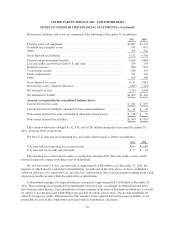

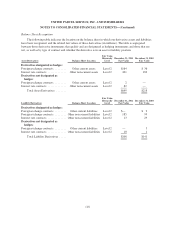

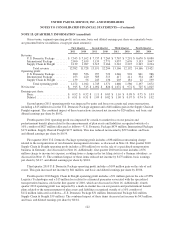

Liability Derivatives Balance Sheet Location

Fair Value

Hierarchy

Level

December 31, 2011

Fair Value

December 31, 2010

Fair Value

Derivatives designated as hedges:

Foreign exchange contracts ........ Other current liabilities Level 2 $— $ 9

Foreign exchange contracts ........ Other non-current liabilities Level 2 185 99

Interest rate contracts ............. Other non-current liabilities Level 2 13 29

Derivatives not designated as

hedges:

Foreign exchange contracts ........ Other current liabilities Level 2 — 3

Interest rate contracts ............. Other non-current liabilities Level 2 10 1

Total Liability Derivatives ..... $208 $141

118