UPS 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The fair value disclosures above have not been provided for our international pension benefit plans since

asset allocations are determined and managed at the individual country level. In general, the asset allocations for

these plans are approximately 55% in equity securities, 35% in debt securities and 10% in other securities. The

amount of assets having significant unobservable inputs (Level 3), if any, in these plans would be immaterial to

our financial statements.

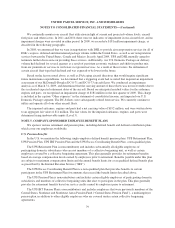

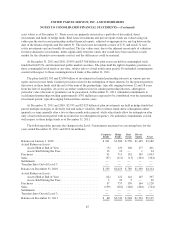

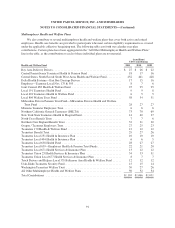

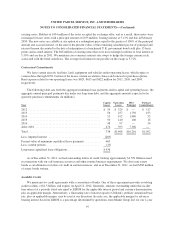

Expected Cash Flows

Information about expected cash flows for the pension and postretirement benefit plans is as follows (in

millions):

U.S.

Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Employer Contributions:

2012 (expected) to plan trusts ..................... $ 355 $ 371 $ 53

2012 (expected) to plan participants ................ 13 101 3

Expected Benefit Payments:

2012 ..................................... $ 708 $ 233 $ 18

2013 ..................................... 789 253 17

2014 ..................................... 873 230 19

2015 ..................................... 966 246 21

2016 ..................................... 1,065 260 23

2017 - 2021 ............................... 7,112 1,466 153

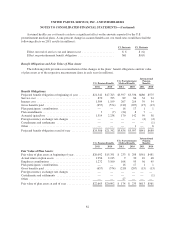

Our funding policy for U.S. plans is to contribute amounts annually that are at least equal to the amounts

required by applicable laws and regulations, or to directly fund payments to plan participants, as applicable.

International plans will be funded in accordance with local regulations. Additional discretionary contributions

may be made when deemed appropriate to meet the long-term obligations of the plans. Expected benefit

payments for pensions will be primarily paid from plan trusts. Expected benefit payments for postretirement

medical benefits will be paid from plan trusts and corporate assets.

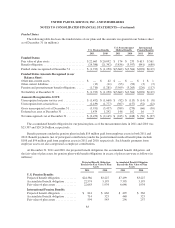

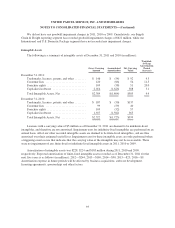

NOTE 6. MULTIEMPLOYER EMPLOYEE BENEFIT PLANS

We contribute to a number of multiemployer defined benefit plans under the terms of collective bargaining

agreements that cover our union-represented employees. These plans generally provide for retirement, death and/

or termination benefits for eligible employees within the applicable collective bargaining units, based on specific

eligibility/participation requirements, vesting periods and benefit formulas. The risks of participating in these

multiemployer plans are different from single-employer plans in the following aspects:

• Assets contributed to the multiemployer plan by one employer may be used to provide benefits to

employees of other participating employers.

• If a participating employer stops contributing to the multiemployer plan, the unfunded obligations of

the plan may be borne by the remaining participating employers.

• If we choose to stop participating in some of our multiemployer plans, we may be required to pay those

plans an amount based on the underfunded status of the plan, referred to as a withdrawal liability.

However, cessation of participation in a multiemployer plan and subsequent payment of any

withdrawal liability is subject to the collective bargaining process.

88