UPS 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

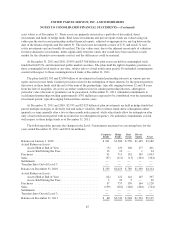

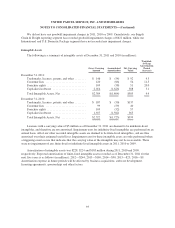

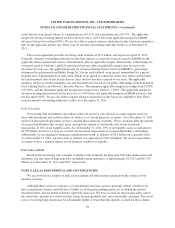

The discussion that follows sets forth the financial impact on our results of operations and cash flows for the

years ended December 31, 2011, 2010 and 2009 from our participation in multiemployer benefit plans. Several

factors could cause us to make significantly higher future contributions to these plans, including unfavorable

investment performance, changes in demographics and increased benefits to participants. However, all

surcharges are subject to the collective bargaining process. At this time, we are unable to determine the amount

of additional future contributions, if any, or whether any material adverse effect on our financial condition,

results of operations or liquidity would result from our participation in these plans.

The number of employees covered by our multiemployer plans has remained consistent over the past three

years, and there have been no significant changes that affect the comparability of 2011, 2010 and 2009

contributions. We recognize expense for the contractually-required contribution for each period, and we

recognize a liability for any contributions due and unpaid at the end of a reporting period.

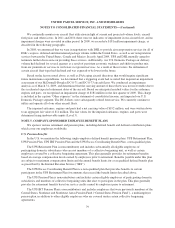

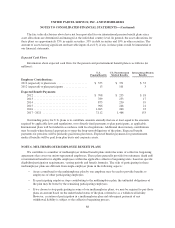

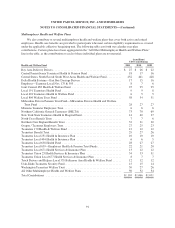

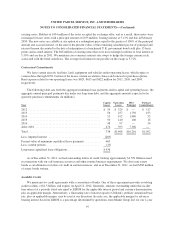

Multiemployer Pension Plans

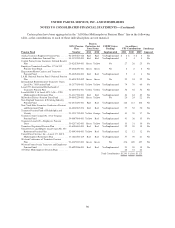

The following table outlines our participation in multiemployer pension plans for the periods ended

December 31, 2011, 2010 and 2009, and sets forth our calendar year contributions into each plan. The “EIN/

Pension Plan Number” column provides the Employer Identification Number (“EIN”) and the three-digit plan

number. The most recent Pension Protection Act zone status available in 2011 and 2010 relates to the plans’ two

most recent fiscal year-ends. The zone status is based on information that we received from the plans’

administrators and is certified by each plan’s actuary. Among other factors, plans certified in the red zone are

generally less than 65% funded, plans certified in the orange zone are both less than 80% funded and have an

accumulated funding deficiency or are expected to have a deficiency in any of the next six plan years, plans

certified in the yellow zone are less than 80% funded, and plans certified in the green zone are at least 80%

funded. The “FIP/RP Status Pending/Implemented” column indicates whether a financial improvement plan

(“FIP”) for yellow/orange zone plans, or a rehabilitation plan (“RP”) for red zone plans, is either pending or has

been implemented. As of December 31, 2011, all plans that have either a FIP or RP requirement have had the

respective FIP or RP implemented.

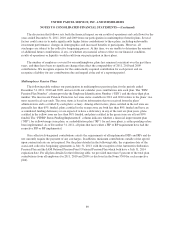

Our collectively-bargained contributions satisfy the requirements of all implemented FIPs and RPs and do

not currently require the payment of any surcharges. In addition, minimum contributions outside of the agreed

upon contractual rate are not required. For the plans detailed in the following table, the expiration date of the

associated collective bargaining agreements is July 31, 2013, with the exception of the Automotive Industries

Pension Plan and the IAM National Pension Fund / National Pension Plan which both have a July 31, 2014

expiration date. For all plans detailed in the following table, we provided more than 5 percent of the total plan

contributions from all employers for 2011, 2010 and 2009 (as disclosed in the Form 5500 for each respective

plan).

89