UPS 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

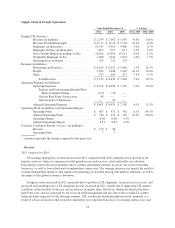

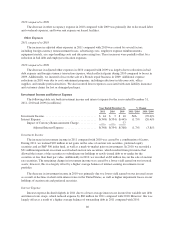

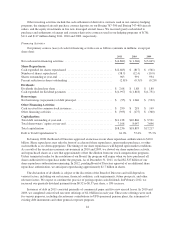

Investing Activities

Our primary sources (uses) of cash for investing activities were as follows (amounts in millions):

2011 2010 2009

Net cash used in investing activities .......................... $(2,537) $ (654) $(1,248)

Capital Expenditures:

Buildings and facilities ..................................... $ (373) $ (352) $ (568)

Aircraft and parts ......................................... (598) (416) (611)

Vehicles ................................................ (659) (339) (209)

Information technology .................................... (375) (282) (214)

$(2,005) $(1,389) $(1,602)

Capital Expenditures as a % of Revenue ....................... 3.8% 2.8% 3.5%

Other Investing Activities:

Proceeds from disposals of property, plant and equipment ......... $ 27 $ 304 $ 60

Net decrease in finance receivables ........................... $ 184 $ 108 $ 261

Net (purchases) sales of marketable securities ................... $ (413) $ 30 $ (11)

Cash received (paid) for business acquisitions and dispositions ..... $ (73) $ 63 $ (9)

Other investing activities ................................... $ (257) $ 230 $ 53

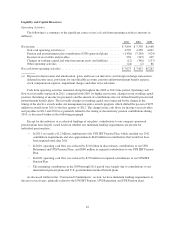

We have commitments for the purchase of aircraft, vehicles, equipment and real estate to provide for the

replacement of existing capacity and anticipated future growth. We generally fund our capital expenditures with

our cash from operations. Capital spending increased in 2011 to support several growth initiatives. In 2010 and

2009, we had reduced capital spending to a level commensurate with our operating needs in the economic

environment at that time. Future capital spending for anticipated growth and replacement assets will depend on a

variety of factors, including economic and industry conditions. We anticipate that our capital expenditures for

2012 will be approximately $2.2 billion, or approximately 4% of revenue.

Capital spending on aircraft over the 2009 to 2011 period was largely due to scheduled deliveries of

previous orders for the Boeing 767-300 and 747-400 aircraft. Capital spending on vehicles increased during 2010

and 2011 in our U.S. and international package businesses and our freight unit, due to vehicle replacements,

technology enhancements and new vehicle orders to support volume growth.

Capital expenditures on buildings and facilities declined over the 2009 through 2011 period, primarily

resulting from the completion of several large hub construction and expansion projects, including our Worldport

hub expansion. In 2009, we completed the first phase of our Worldport expansion, which increased the sorting

capacity by 15%. The final phase of the Worldport expansion was completed in 2010, with an additional sorting

capacity of approximately 20%. We anticipate that capital spending on buildings and facilities will increase in

2012, due to expansion and new construction projects at facilities in Europe and Asia, including a $200 million

expansion at our European air hub in Cologne, Germany during 2012 and 2013.

The 2010 increase in proceeds from the disposal of property, plant and equipment is largely due to real

estate sales and the proceeds from insurance recoveries. The net decline in finance receivables in the 2009

through 2011 period is primarily due to customer paydowns and loan sales activity, primarily in our commercial

lending, asset-based lending and leasing portfolios. The purchases and sales of marketable securities are largely

determined by liquidity needs and the periodic rebalancing of investment types, and will therefore fluctuate from

period to period.

The cash paid for business acquisitions in 2011 was largely due to the acquisition of Pieffe Group in Italy.

The cash received from business dispositions in 2010 was largely due to the sale of UPS Logistics Technologies,

Inc. In 2009, the cash outflow for the purchase of Unsped Paket Servisi San ve Ticaret A.S. was largely offset by

the cash received from the sale of the international franchise operations of our Mail Boxes Etc. unit.

43