UPS 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

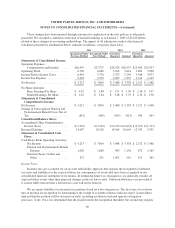

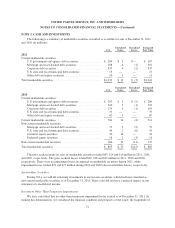

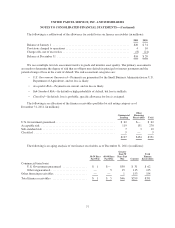

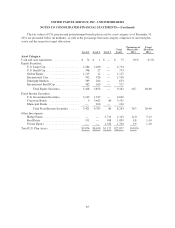

The following is an analysis of impaired finance receivables as of December 31, 2011 (in millions):

Recorded

Investment

Unpaid

Principal

Balance

Related

Allowance

Average

Recorded

Investment

Interest

Income

Recognized

Impaired loans with related allowance ............ $ 9 $ 36 $ 7 $14 $—

Impaired loans with no related allowance ......... 7 80 — 12 —

Impaired loans with U.S. government guarantee .... 35 35 — 51 —

Total impaired loans .......................... $51 $151 $ 7 $77 $—

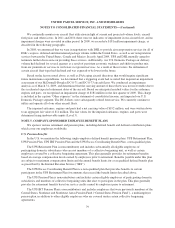

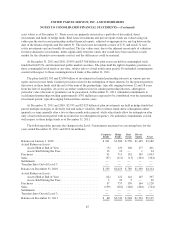

The carrying value of finance receivables at December 31, 2011, by contractual maturity, is shown below

(in millions). Actual maturities may differ from contractual maturities because some borrowers have the right to

prepay these receivables without prepayment penalties.

Carrying

Value

Due in one year or less ....................................................... $130

Due after one year through three years ........................................... 33

Due after three years through five years .......................................... 28

Due after five years .......................................................... 160

$351

Based on interest rates for financial instruments with similar terms and maturities, the estimated fair value

of finance receivables is approximately $335 and $491 million as of December 31, 2011 and 2010, respectively.

At December 31, 2011, we had unfunded loan commitments totaling $248 million, consisting of standby letters

of credit of $29 million and other unfunded lending commitments of $219 million.

During 2009, impaired finance receivables with a carrying amount of $13 million were written down to a

net fair value of $8 million, based on the fair value for the related collateral which was determined using

unobservable inputs (Level 3).

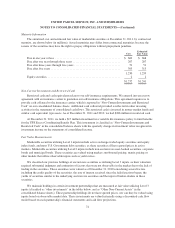

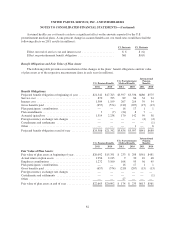

NOTE 4. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment, including both owned assets as well as assets subject to capital leases,

consists of the following as of December 31 (in millions):

2011 2010

Vehicles ....................................................... $ 5,981 $ 5,519

Aircraft ........................................................ 14,616 14,063

Land .......................................................... 1,114 1,081

Buildings ....................................................... 3,095 3,102

Building and leasehold improvements ................................ 2,943 2,860

Plant equipment ................................................. 6,803 6,656

Technology equipment ............................................ 1,593 1,552

Equipment under operating leases ................................... 93 122

Construction-in-progress .......................................... 303 265

36,541 35,220

Less: Accumulated depreciation and amortization ....................... (18,920) (17,833)

$ 17,621 $ 17,387

78