UPS 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

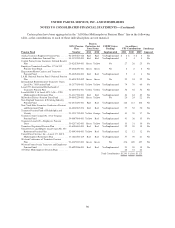

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

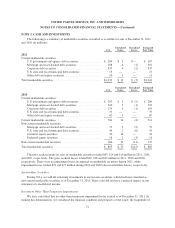

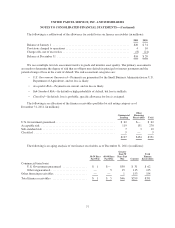

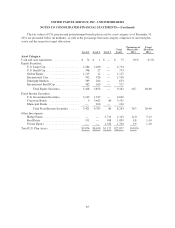

Assumed health care cost trends can have a significant effect on the amounts reported for the U.S.

postretirement medical plans. A one-percent change in assumed health care cost trend rates would have had the

following effects on 2011 results (in millions):

1% Increase 1% Decrease

Effect on total of service cost and interest cost ...................... $ 6 $ (6)

Effect on postretirement benefit obligation ......................... $61 $(65)

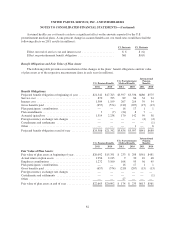

Benefit Obligations and Fair Value of Plan Assets

The following table provides a reconciliation of the changes in the plans’ benefit obligations and fair value

of plan assets as of the respective measurement dates in each year (in millions).

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International

Pension

Benefits

2011 2010 2011 2010 2011 2010

Benefit Obligations:

Projected benefit obligation at beginning of year ........ $21,342 $17,763 $3,597 $3,336 $680 $575

Service cost ..................................... 870 723 89 86 34 24

Interest cost ..................................... 1,309 1,199 207 214 39 34

Gross benefits paid ............................... (657) (574) (219) (207) (15) (13)

Plan participants’ contributions ...................... — — 16 17 1 1

Plan amendments ................................. 3 (7) (24) 8 7 —

Actuarial (gain)/loss .............................. 1,519 2,238 170 142 99 58

Foreign currency exchange rate changes .............. — — — — (4) (4)

Curtailments and settlements ....................... — — — — — (1)

Other .......................................... — — — 1 — 6

Projected benefit obligation at end of year ............. $24,386 $21,342 $3,836 $3,597 $841 $680

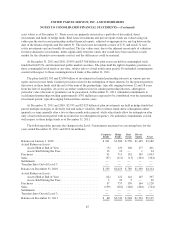

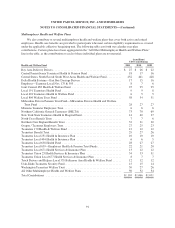

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International

Pension

Benefits

2011 2010 2011 2010 2011 2010

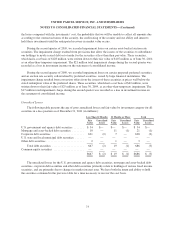

Fair Value of Plan Assets:

Fair value of plan assets at beginning of year ........... $20,092 $15,351 $ 233 $ 298 $561 $481

Actual return on plan assets ........................ 1,956 2,215 9 30 10 48

Employer contributions ............................ 1,272 3,100 108 95 56 45

Plan participants’ contributions ...................... — — 16 17 1 1

Gross benefits paid ............................... (657) (574) (219) (207) (15) (13)

Foreign currency exchange rate changes .............. — — — — — —

Curtailments and settlements ....................... — — — — — (1)

Other .......................................... — — 27 — — —

Fair value of plan assets at end of year ................ $22,663 $20,092 $ 174 $ 233 $613 $561

82