UPS 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

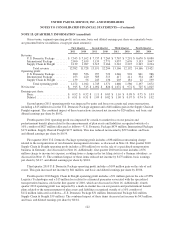

twelve months. Items that may cause changes to unrecognized tax benefits include the timing of interest

deductions and the allocation of income and expense between tax jurisdictions. These changes could result from

the settlement of ongoing litigation, the completion of ongoing examinations, the expiration of the statute of

limitations, or other unforeseen circumstances. At this time, an estimate of the range of the reasonably possible

change cannot be made.

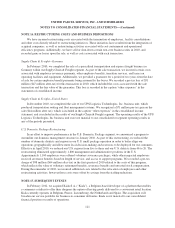

In June 2011, we received IRS reports covering income taxes and excise taxes for tax years 2005 through

2007 and 2003 through 2007, respectively. The reports propose assessments related to amounts paid for software,

research credit expenditures and deductibility of financing and post-acquisition integration costs as well as taxes

on amounts paid for air transportation. Receipt of the reports represents only the conclusion of the examination

process. We disagree with the proposed assessments related to these matters. Therefore, we have filed protests

and protective tax refund claims. During the third quarter of 2011, the IRS responded to our protests and

forwarded the cases to IRS Appeals. There are multiple factors that prevent us from being able to estimate the

amount of loss, if any, that may result from these matters including: (1) we are vigorously defending these

matters and believe that we have a number of meritorious legal defenses; (2) we have filed refund claims in

excess of the proposed assessments; (3) there are unresolved questions of law and fact that could be of

importance to the ultimate resolutions of these matters, including the calculation of any additional taxes and/or

tax refunds; and (4) these matters are at the initial stage of a multi-level administrative appeals process that may

ultimately be resolved by litigation. Accordingly, at this time, we are not able to estimate a possible loss or range

of loss that may result from these matters or to determine whether such loss, if any, would have a material

adverse effect on our financial condition, results of operations or liquidity.

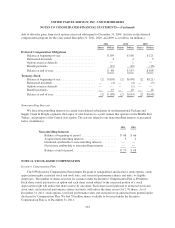

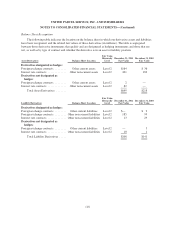

NOTE 14. EARNINGS PER SHARE

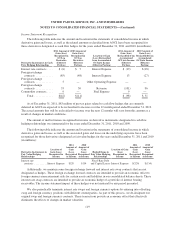

The following table sets forth the computation of basic and diluted earnings per share (in millions, except

per share amounts):

2011 2010 2009

Numerator:

Net income attributable to common shareowners ......................... $3,804 $3,338 $1,968

Denominator:

Weighted average shares ............................................ 977 991 995

Deferred compensation obligations ....................................222

Vested portion of restricted shares .....................................211

Denominator for basic earnings per share ................................... 981 994 998

Effect of dilutive securities:

Restricted performance units .........................................332

Restricted stock units ...............................................664

Stock options ..................................................... 1 — —

Denominator for diluted earnings per share .................................. 991 1,003 1,004

Basic earnings per share ................................................. $ 3.88 $ 3.36 $ 1.97

Diluted earnings per share ............................................... $ 3.84 $ 3.33 $ 1.96

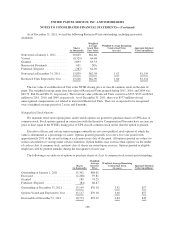

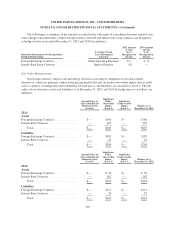

Diluted earnings per share for the years ended December 31, 2011, 2010, and 2009 exclude the effect of 7.4,

11.1 and 17.4 million shares, respectively, of common stock that may be issued upon the exercise of employee

stock options because such effect would be antidilutive.

114