UPS 2011 Annual Report Download - page 59

Download and view the complete annual report

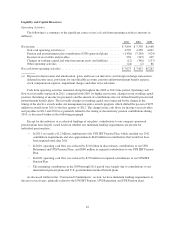

Please find page 59 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.current projections, the actual contributions made in future years could materially differ from the amounts shown

in the table above. Additionally, we have not included minimum funding requirements beyond 2017, because

these projected contributions are not reasonably determinable.

We are not subject to any minimum funding requirement for cash contributions in 2012 in the UPS

Retirement Plan or UPS Pension Plan. The amount of any minimum funding requirement, as applicable, for these

plans could change significantly in future periods, depending on many factors, including future plan asset returns

and discount rates. A sustained significant decline in the world equity markets, and the resulting impact on our

pension assets and investment returns, could result in our domestic pension plans being subject to significantly

higher minimum funding requirements. Such an outcome could have a material adverse impact on our financial

position and cash flows in future periods.

As discussed in Note 6 to our consolidated financial statements, we are not currently subject to any

minimum contributions or surcharges with respect to the multiemployer pension and health and welfare plans in

which we participate. Contribution rates to these multiemployer pension and health and welfare plans are

established through the collective bargaining process. As we are not subject to any minimum contribution levels,

we have not included any amounts in the contractual commitments table with respect to these multiemployer

plans.

The contractual payments due for “other liabilities” primarily include commitment payments related to our

investment in certain partnerships. The table above does not include approximately $252 million of liabilities for

uncertain tax positions because we are uncertain if or when such amounts will ultimately be settled in cash. In

addition, we also have recognized assets associated with uncertain tax positions in excess of the related liabilities

such that we do not believe a net contractual obligation exists to the taxing authorities. Uncertain tax positions

are further discussed in Note 13 to the consolidated financial statements.

As of December 31, 2011, we had outstanding letters of credit totaling approximately $1.551 billion issued

in connection with routine business requirements. We also issue surety bonds as an alternative to letters of credit

in certain instances, and as of December 31, 2011, we had $583 million of surety bonds written. As of

December 31, 2011, we had unfunded loan commitments totaling $248 million associated with our financial

business.

We believe that funds from operations and borrowing programs will provide adequate sources of liquidity

and capital resources to meet our expected long-term needs for the operation of our business, including

anticipated capital expenditures, for the foreseeable future.

Contingencies

We are involved in a number of judicial proceedings and other matters arising from the conduct of our

business activities.

Although there can be no assurance as to the ultimate outcome, we have generally denied, or believe we

have a meritorious defense and will deny, liability in all litigation pending against us, including the matters

described below, and we intend to defend vigorously each case. We have accrued for legal claims when, and to

the extent that, amounts associated with the claims become probable and can be reasonably estimated. The actual

costs of resolving legal claims may be substantially higher or lower than the amounts accrued for those claims.

For those matters as to which we are not able to estimate a possible loss or range of loss, we are not able to

determine whether the loss will have a material adverse effect on our business, financial condition or results of

operations or liquidity. For matters in this category, we have indicated in the descriptions that follow the reasons

that we are unable to estimate the possible loss or range of loss.

Judicial Proceedings

We are a defendant in a number of lawsuits filed in state and federal courts containing various class action

allegations under state wage-and-hour laws. At this time, we do not believe that any loss associated with these

matters, would have a material adverse effect on our financial condition, results of operations or liquidity.

UPS and our subsidiary Mail Boxes Etc., Inc. are defendants in two lawsuits about the rebranding or

purchase of The UPS Store franchises—Morgate and Samica. We prevailed at the trial court level in both cases,

47