UPS 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension and Postretirement Medical Benefits

Our pension and other postretirement benefit costs are calculated using various actuarial assumptions and

methodologies. These assumptions include discount rates, health care cost trend rates, inflation, compensation

increase rates, expected returns on plan assets, mortality rates and other factors. The assumptions utilized in

recording the obligations under our plans represent our best estimates, and we believe that they are reasonable,

based on information as to historical experience and performance as well as other factors that might cause future

expectations to differ from past trends.

Differences in actual experience or changes in assumptions may affect our pension and other postretirement

obligations and future expense. The primary factors contributing to actuarial gains and losses each year are

(1) changes in the discount rate used to value pension and postretirement benefit obligations as of the

measurement date and (2) differences between the expected and the actual return on plan assets.

In the fourth quarter of 2011, we elected to change our accounting methodologies for recognizing expense

for our company-sponsored U.S. and International pension and other postretirement benefit plans. Previously, net

actuarial gains or losses in excess of 10% of the greater of the market-related value of plan assets or the plans’

projected benefit obligations (the “corridor”) were recognized over the average remaining service life of

employees in each respective plan. Further, for our largest pension plan (the UPS Retirement Plan), we used a

calculated value of plan assets reflecting changes in the fair value of plan assets over a five-year period.

Under our new accounting methods, we will recognize changes in the fair value of plan assets and net

actuarial gains or losses in excess of the corridor annually in the fourth quarter each year. These new accounting

methods result in changes in the fair value of plan assets and net actuarial gains and losses being recognized in

expense faster than our previous amortization method. The remaining components of pension expense, primarily

service and interest costs and the expected return on plan assets, will be recorded on a quarterly basis as ongoing

pension expense (herein referred to as “ongoing expense” or “ongoing net periodic benefit cost”).

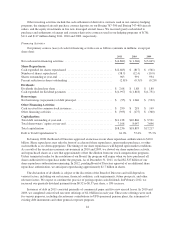

The following sensitivity analysis shows the impact of a 25 basis point change in the assumed discount rate,

expected return on assets, and health care cost trend rate for our pension and postretirement benefit plans, and the

resulting increase (decrease) on our obligations and ongoing expense as of, and for the year ended, December 31,

2011 (in millions).

25 Basis Point

Increase

25 Basis Point

Decrease

Pension Plans

Discount Rate:

Effect on ongoing net periodic benefit cost ................... $ (43) $ 45

Effect on projected benefit obligation ....................... (976) 1,017

Return on Assets:

Effect on ongoing net periodic benefit cost ................... (54) 54

Postretirement Medical Plans

Discount Rate:

Effect on ongoing net periodic benefit cost ................... — —

Effect on accumulated postretirement benefit obligation ......... (102) 105

Health Care Cost Trend Rate:

Effect on ongoing net periodic benefit cost ................... 1 (1)

Effect on accumulated postretirement benefit obligation ......... 15 (16)

54