UPS 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

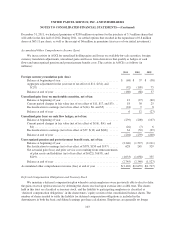

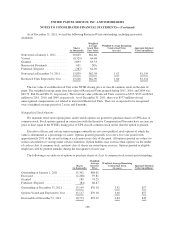

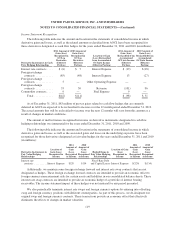

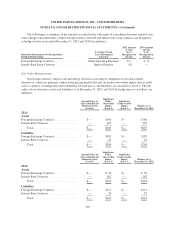

A reconciliation of the statutory federal income tax rate to the effective income tax rate for the years ended

December 31 consists of the following:

2011 2010 2009

Statutory U.S. federal income tax rate .................................. 35.0% 35.0% 35.0%

U.S. state and local income taxes (net of federal benefit) ................... 2.0 2.4 1.2

Non-U.S. tax rate differential ......................................... (0.4) (0.7) (1.6)

Nondeductible/nontaxable items ...................................... (0.1) 0.3 1.0

U.S. federal tax credits .............................................. (1.7) (1.9) (3.5)

Other ............................................................ (0.7) 1.8 3.9

Effective income tax rate ............................................ 34.1% 36.9% 36.0%

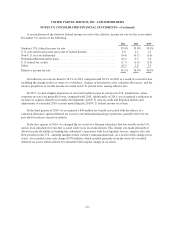

Our effective tax rate declined to 34.1% in 2011 compared with 36.9% in 2010 as a result of several factors,

including the change in the tax status of a subsidiary, changes in deferred tax asset valuation allowances, and the

relative proportion of taxable income in certain non-U.S. jurisdictions, among other factors.

In 2011, we had a higher proportion of our total taxable income in certain non-U.S. jurisdictions, where

corporate tax rates are generally lower, compared with 2010. Additionally in 2011, we recognized a reduction in

income tax expense related to favorable developments with U.S. state tax audit and litigation matters and

adjustments of estimated 2010 accruals upon filing the 2010 U.S. federal income tax return.

In the third quarter of 2010, we recognized a $40 million tax benefit associated with the release of a

valuation allowance against deferred tax assets in our international package operations, partially offset by tax

provided for interest earned on refunds.

In the first quarter of 2010, we changed the tax status of a German subsidiary that was taxable in the U.S.

and its local jurisdiction to one that is taxed solely in its local jurisdiction. This change was made primarily to

allow for more flexibility in funding this subsidiary’s operations with local liquidity sources, improve the cash

flow position in the U.S., and help mitigate future currency remeasurement risk. As a result of this change in tax

status, we recorded a non-cash charge of $76 million, which resulted primarily from the write-off of related

deferred tax assets which will not be realizable following the change in tax status.

111