UPS 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The decrease in adjusted interest expense in 2010 compared with 2009 was primarily due to lower average

debt balances, but this was partially offset by lower capitalized interest, due to the recent completion of several

large construction projects, including our Worldport expansion.

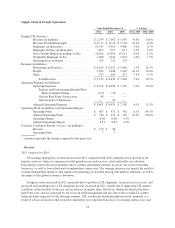

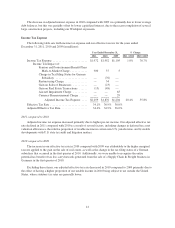

Income Tax Expense

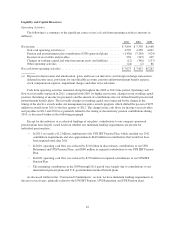

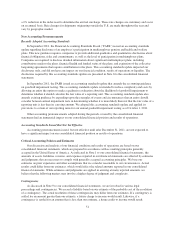

The following table sets forth income tax expense and our effective tax rate for the years ended

December 31, 2011, 2010 and 2009 (in millions):

Year Ended December 31, % Change

2011 2010 2009 2011 / 2010 2010 / 2009

Income Tax Expense ........................ $1,972 $1,952 $1,105 1.0% 76.7%

Income Tax Impact of:

Pension and Postretirement Benefit Plans

Mark-to-Market Charge ............ 300 37 5

Change in Tax Filing Status for German

Subsidiary ...................... — (76) —

Restructuring Charge ................ — 34 —

Gain on Sales of Businesses .......... — (23) —

Gain on Real Estate Transactions ...... (13) (48) —

Aircraft Impairment Charge .......... — — 65

Currency Remeasurement Charge ...... — — 29

Adjusted Income Tax Expense .... $2,259 $1,876 $1,204 20.4% 55.8%

Effective Tax Rate .......................... 34.1% 36.9% 36.0%

Adjusted Effective Tax Rate .................. 34.4% 34.9% 36.0%

2011 compared to 2010

Adjusted income tax expense increased primarily due to higher pre-tax income. Our adjusted effective tax

rate declined in 2011 compared with 2010 as a result of several factors, including changes in deferred tax asset

valuation allowances, the relative proportion of taxable income in certain non-U.S. jurisdictions, and favorable

developments with U.S. state tax audit and litigation matters.

2010 compared to 2009

The increase in our effective tax rate in 2010 compared with 2009 was attributable to the higher marginal

tax rate applied to the gain on the sale of real estate, as well as the change in the tax filing status of a German

subsidiary that occurred in the first quarter of 2010. Additionally, we were unable to recognize the entire

potential tax benefit of tax loss carryforwards generated from the sale of a Supply Chain & Freight business in

Germany in the first quarter of 2010.

Excluding these items, our adjusted effective tax rate decreased in 2010 compared to 2009 primarily due to

the effect of having a higher proportion of our taxable income in 2010 being subject to tax outside the United

States, where statutory tax rates are generally lower.

41