UPS 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

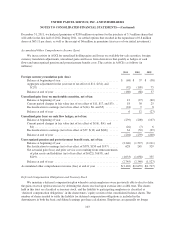

Employees purchased 1.3, 1.5 and 0.6 million shares at average prices of $66.86, $57.98 and $44.30 per share

during 2011, 2010, and 2009, respectively. Subsequent to the modification, the plan is no longer considered to be

compensatory, and therefore no compensation cost is measured for the modified employees’ purchase rights.

Prior to the modification, compensation cost was measured for the fair value of employees’ purchase rights under

our discounted employee stock purchase plan using the Black-Scholes option pricing model, and we determined

the weighted average fair value of the employee purchase rights to be $7.52 per share for 2009.

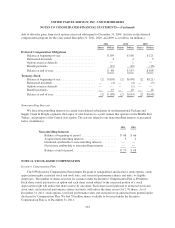

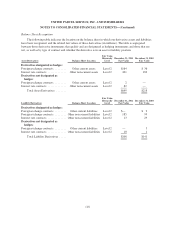

NOTE 12. SEGMENT AND GEOGRAPHIC INFORMATION

We report our operations in three segments: U.S. Domestic Package operations, International Package

operations and Supply Chain & Freight operations. Package operations represent our most significant business

and are broken down into regional operations around the world. Regional operations managers are responsible

for both domestic and export operations within their geographic area.

U.S. Domestic Package

Domestic Package operations include the time-definite delivery of letters, documents and packages

throughout the United States.

International Package

International Package operations include delivery to more than 220 countries and territories worldwide,

including shipments wholly outside the United States, as well as shipments with either origin or destination

outside the United States. Our International Package reporting segment includes the operations of our Europe,

Asia and Americas operating segments.

Supply Chain & Freight

Supply Chain & Freight includes our forwarding and logistics operations, UPS Freight and other aggregated

business units. Our forwarding and logistics business provides services in more than 195 countries and territories

worldwide, and includes supply chain design and management, freight distribution, customs brokerage, mail and

consulting services. UPS Freight offers a variety of LTL and TL services to customers in North America. Other

aggregated business units within this segment include Mail Boxes Etc. (the franchisor of Mail Boxes Etc. and

The UPS Store) and UPS Capital.

In evaluating financial performance, we focus on operating profit as a segment’s measure of profit or loss.

Operating profit is before investment income, interest expense and income taxes. The accounting policies of the

reportable segments are the same as those described in the summary of accounting policies (see Note 1), with

certain expenses allocated between the segments using activity-based costing methods. Unallocated assets are

comprised primarily of cash, marketable securities, and certain investment partnerships.

108