UPS 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

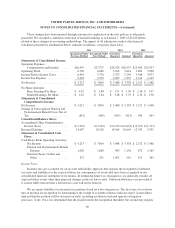

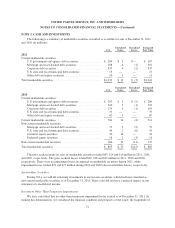

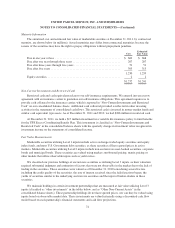

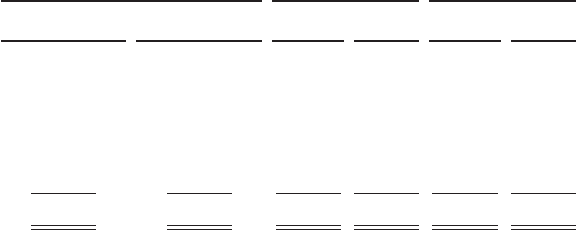

These changes have been reported through retrospective application of the new policies to all periods

presented. We recorded a cumulative reduction of retained earnings as of January 1, 2009 of $3.226 billion

related to these changes in accounting methodology. The impact of all adjustments made to the financial

statements presented is summarized below (amounts in millions, except per share data):

2011 2010 2009

Recognized Under

Previous Method

Recognized Under

New Method

Previously

Reported Adjusted

Previously

Reported Adjusted

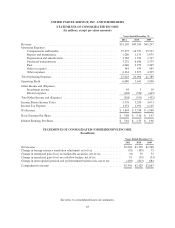

Statements of Consolidated Income:

Operating Expenses:

Compensation and benefits ...... $26,935 $27,575 $26,324 $26,557 $25,640 $25,933

Operating Profit ................... 6,720 6,080 5,874 5,641 3,801 3,508

Income Before Income Taxes ........ 6,416 5,776 5,523 5,290 3,366 3,073

Income Tax Expense ............... 2,203 1,972 2,035 1,952 1,214 1,105

Net Income ....................... $ 4,213 $ 3,804 $ 3,488 $ 3,338 $ 2,152 $ 1,968

Per Share Amounts:

Basic Earnings Per Share ........ $ 4.29 $ 3.88 $ 3.51 $ 3.36 $ 2.16 $ 1.97

Diluted Earnings Per Share ...... $ 4.25 $ 3.84 $ 3.48 $ 3.33 $ 2.14 $ 1.96

Statements of Consolidated

Comprehensive Income:

Net Income ....................... $ 4,213 $ 3,804 $ 3,488 $ 3,338 $ 2,152 $ 1,968

Change in Unrecognized Pension and

Postretirement Benefit Costs, Net of

Tax ........................... (814) (405) (963) (813) 500 684

Consolidated Balance Sheet:

Accumulated Other Comprehensive

Income (Loss) ................... $(7,072) $ (3,103) $ (6,195) $ (2,635) $ (5,127) $ (1,717)

Retained Earnings ................. 14,097 10,128 14,164 10,604 12,745 9,335

Statement of Consolidated Cash

Flows:

Cash Flows From Operating Activities:

Net Income ................... $ 4,213 $ 3,804 $ 3,488 $ 3,338 $ 2,152 $ 1,968

Pension and Postretirement Benefit

Expense ................... 1,020 1,660 903 1,136 872 1,165

Deferred Taxes, Credits and

Other ...................... 472 241 1,002 919 471 362

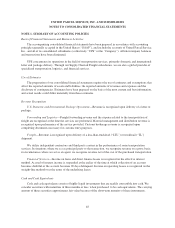

Income Taxes

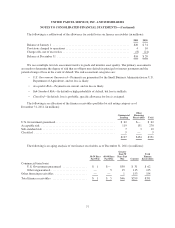

Income taxes are accounted for on an asset and liability approach that requires the recognition of deferred

tax assets and liabilities for the expected future tax consequences of events that have been recognized in our

consolidated financial statements or tax returns. In estimating future tax consequences, we generally consider all

expected future events other than proposed changes in the tax law or rates. Valuation allowances are provided if

it is more likely than not that a deferred tax asset will not be realized.

We recognize liabilities for uncertain tax positions based on a two-step process. The first step is to evaluate

the tax position for recognition by determining if the weight of available evidence indicates that it is more likely

than not that the position will be sustained on audit, including resolution of related appeals or litigation

processes, if any. Once it is determined that the position meets the recognition threshold, the second step requires

69