UPS 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

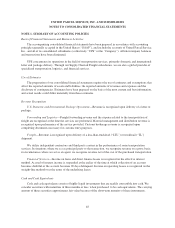

NOTE 1. SUMMARY OF ACCOUNTING POLICIES

Basis of Financial Statements and Business Activities

The accompanying consolidated financial statements have been prepared in accordance with accounting

principles generally accepted in the United States (“GAAP”), and include the accounts of United Parcel Service,

Inc., and all of its consolidated subsidiaries (collectively “UPS” or the “Company”). All intercompany balances

and transactions have been eliminated.

UPS concentrates its operations in the field of transportation services, primarily domestic and international

letter and package delivery. Through our Supply Chain & Freight subsidiaries, we are also a global provider of

specialized transportation, logistics, and financial services.

Use of Estimates

The preparation of our consolidated financial statements requires the use of estimates and assumptions that

affect the reported amounts of assets and liabilities, the reported amounts of revenues and expenses and the

disclosure of contingencies. Estimates have been prepared on the basis of the most current and best information,

and actual results could differ materially from those estimates.

Revenue Recognition

U.S. Domestic and International Package Operations—Revenue is recognized upon delivery of a letter or

package.

Forwarding and Logistics—Freight forwarding revenue and the expense related to the transportation of

freight are recognized at the time the services are performed. Material management and distribution revenue is

recognized upon performance of the service provided. Customs brokerage revenue is recognized upon

completing documents necessary for customs entry purposes.

Freight—Revenue is recognized upon delivery of a less-than-truckload (“LTL”) or truckload (“TL”)

shipment.

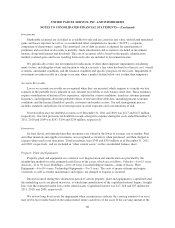

We utilize independent contractors and third party carriers in the performance of some transportation

services. In situations where we act as principal party to the transaction, we recognize revenue on a gross basis;

in circumstances where we act as an agent, we recognize revenue net of the cost of the purchased transportation.

Financial Services—Income on loans and direct finance leases is recognized on the effective interest

method. Accrual of interest income is suspended at the earlier of the time at which collection of an account

becomes doubtful or the account becomes 90 days delinquent. Income on operating leases is recognized on the

straight-line method over the terms of the underlying leases.

Cash and Cash Equivalents

Cash and cash equivalents consist of highly liquid investments that are readily convertible into cash. We

consider securities with maturities of three months or less, when purchased, to be cash equivalents. The carrying

amount of these securities approximates fair value because of the short-term maturity of these instruments.

65