UPS 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

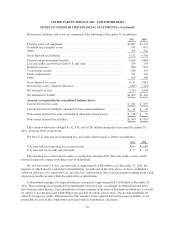

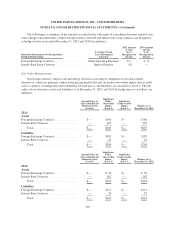

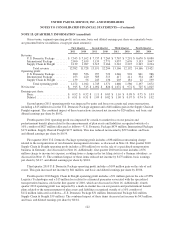

NOTE 18. QUARTERLY INFORMATION (unaudited)

Our revenue, segment operating profit, net income, basic and diluted earnings per share on a quarterly basis

are presented below (in millions, except per share amounts):

First Quarter Second Quarter Third Quarter Fourth Quarter

2011 2010 2011 2010 2011 2010 2011 2010

Revenue:

U.S. Domestic Package ........ $ 7,543 $ 7,102 $ 7,737 $ 7,269 $ 7,767 $ 7,291 $ 8,670 $ 8,080

International Package ......... 2,900 2,639 3,139 2,771 3,057 2,676 3,153 3,047

Supply Chain & Freight ....... 2,139 1,987 2,315 2,164 2,342 2,225 2,343 2,294

Total revenue ............ 12,582 11,728 13,191 12,204 13,166 12,192 14,166 13,421

Operating profit:

U.S. Domestic Package ........ 880 536 997 722 1,046 994 841 986

International Package ......... 453 420 505 513 417 411 334 487

Supply Chain & Freight ....... 139 56 243 136 203 181 22 199

Total operating profit ..... 1,472 1,012 1,745 1,371 1,666 1,586 1,197 1,672

Net income ..................... $ 915 $ 515 $ 1,092 $ 826 $ 1,072 $ 972 $ 725 $ 1,025

Earnings per share:

Basic ...................... $ 0.92 $ 0.52 $ 1.11 $ 0.83 $ 1.10 $ 0.98 $ 0.75 $ 1.03

Diluted ..................... $ 0.91 $ 0.51 $ 1.09 $ 0.82 $ 1.09 $ 0.97 $ 0.74 $ 1.02

Second quarter 2011 operating profit was impacted by gains and losses on certain real estate transactions,

including a $15 million loss in the U.S. Domestic Package segment and a $48 million gain in the Supply Chain &

Freight segment. The combined impact of these transactions increased net income by $20 million, and basic and

diluted earnings per share by $0.02.

Fourth quarter 2011 operating profit was impacted by a mark-to-market loss on our pension and

postretirement benefit plans related to the remeasurement of plan assets and liabilities recognized outside of a

10% corridor of $827 million (allocated as follows—U.S. Domestic Package $479 million, International Package

$171 million, Supply Chain & Freight $177 million). This loss reduced net income by $527 million, and basic

and diluted earnings per share by $0.54.

First quarter 2010 U.S. Domestic Package operating profit includes a $98 million restructuring charge

related to the reorganization of our domestic management structure, as discussed in Note 16. First quarter 2010

Supply Chain & Freight operating profit includes a $38 million loss on the sale of a specialized transportation

business in Germany, also discussed in Note 16. Additionally, first quarter 2010 net income includes a $76

million charge to income tax expense, resulting from a change in the tax filing status of a German subsidiary, as

discussed in Note 13. The combined impact of these items reduced net income by $175 million, basic earnings

per share by $0.17, and diluted earnings per share by $0.18.

Third quarter 2010 U.S. Domestic Package operating profit includes a $109 million gain on the sale of real

estate. This gain increased net income by $61 million, and basic and diluted earnings per share by $0.06.

Fourth quarter 2010 Supply Chain & Freight operating profit includes a $71 million gain on the sale of UPS

Logistics Technologies and a $13 million loss related to a financial guarantee associated with the specialized

transportation business sold in the first quarter of 2010, which are discussed in Note 16. Additionally, fourth

quarter 2010 operating profit was impacted by a mark-to-market loss on our pension and postretirement benefit

plans related to the remeasurement of plan assets and liabilities recognized outside of a 10% corridor of

$112 million (allocated as follows—U.S. Domestic Package $31 million, International Package $42 million,

Supply Chain & Freight $39 million). The combined impact of these items decreased net income by $43 million,

and basic and diluted earnings per share by $0.04.

122