UPS 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

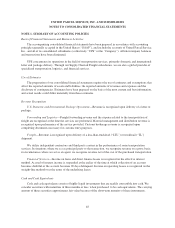

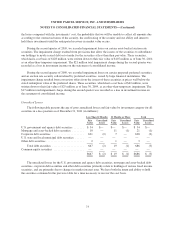

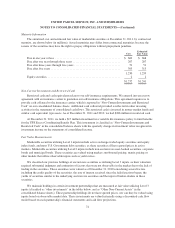

We participate in a number of trustee-managed multiemployer pension and health and welfare plans for

employees covered under collective bargaining agreements. Our contributions to these plans are determined in

accordance with the respective collective bargaining agreements. We recognize expense for the contractually

required contribution for each period, and we recognize a liability for any contributions due and unpaid (included

in “other current liabilities”).

In the fourth quarter of 2011, we elected to change our accounting methodologies for recognizing expense

for our company-sponsored U.S. and international pension and other postretirement benefit plans. Previously, net

actuarial gains or losses in excess of 10% of the greater of the market-related value of plan assets or the plans’

projected benefit obligations (the “corridor”) were recognized over the average remaining service life of

employees in each respective plan. Further, for our largest pension plan (the UPS Retirement Plan), we used a

calculated value of plan assets reflecting changes in the fair value of plan assets over a five-year period.

Under our new accounting methods, we will recognize changes in the fair value of plan assets and net

actuarial gains or losses in excess of the corridor annually in the fourth quarter each year. These new accounting

methods result in changes in the fair value of plan assets and net actuarial gains and losses being recognized in

expense faster than our previous amortization method. The remaining components of pension expense, primarily

service and interest costs and the expected return on plan assets, will be recorded on a quarterly basis as ongoing

pension expense. While the historical policy of recognizing pension and other postretirement benefit expense was

considered acceptable, we believe that these new policies are preferable as they accelerate the recognition in our

operating results of changes in the fair value of plan assets and actuarial gains and losses outside the corridor.

68