UPS 2011 Annual Report Download - page 45

Download and view the complete annual report

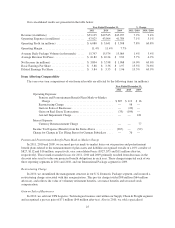

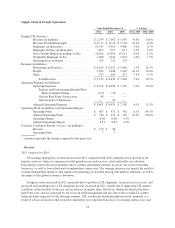

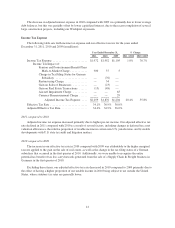

Please find page 45 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.package sort expenses. Network costs increased $498 million for the year due largely to higher fuel costs and

increased block hours. Pick-up and delivery costs increased $270 million for the year, primarily as a result of

higher fuel prices and increased package volume. Package sorting expenses increased $61 million, and were

impacted by higher labor costs and increased depreciation on certain operating facilities.

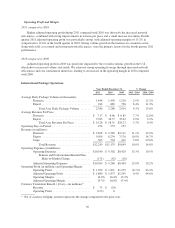

Operating Profit and Margin

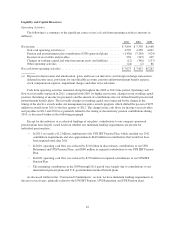

2011 compared to 2010

Adjusted operating profit increased slightly in 2011 compared with 2010, while the segment operating

margin declined for the year due to several factors. The overall increase in adjusted operating profit was largely

due to the volume and revenue per piece increases previously discussed; however, the impact of these items was

largely offset by excess capacity and the adverse impact of fuel prices and currency exchange rate movements.

Volume softness in the Asia-to-U.S. trade lane in the latter half of 2011 resulted in excess transportation

capacity, which pressured margins while our transportation network was being adjusted for the slowing demand.

Fluctuations in foreign currency exchange rates (net of our hedging programs) resulted in an adverse impact on

operating profit comparisons between 2011 and 2010 of $123 million. Additionally, fuel prices adversely

impacted the operating profit comparison between 2011 and 2010, as fuel expense increased at a faster pace than

fuel surcharge revenue. These factors resulted in a decrease in the operating margin in 2011 compared with 2010.

2010 compared to 2009

The increase in operating profit for 2010 was primarily driven by volume increases in all major regions and

trade lanes worldwide. The shift in product mix to our higher-margin premium services also contributed to the

increase in operating profits. Additionally, network efficiencies and cost containment initiatives created operating

leverage throughout our operations. These factors led to an increase in the operating margin in 2010 compared

with 2009.

33