UPS 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

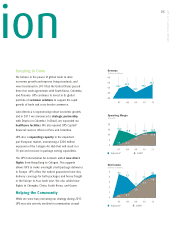

As we begin 2012, growth

in the Euro zone and

Asia is slowing, while the

United States economy is

improving at a modest rate.

Our expectation is for

mixed economic growth

around the world in 2012.

Overall we expect global

economic expansion to be

slightly weaker than 2011.

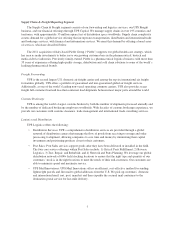

In spite of the macro outlook, UPS expects another

record performance, with earnings per share in a

range of $4.75 to $5.00. That’s an increase of 9 to 15

percent over 2011 adjusted* earnings of $4.35.

New Opportunities

I remain confident that our competitive differentiators

are sustainable for the long term. Our brand is respected

around the world, and our global investments have

positioned us to benefit from economic growth and

expanding global commerce. Our superior worldwide

capabilities are unique in our industry. In our long

history, our heritage and legacy of intellectual property

is difficult to match. Our track record of strong cash

generation will continue to provide us with opportunities

to reinvest and reward shareowners. Finally, our strong

culture of reinventing our business model will ensure

we meet the ever-changing needs of supply chains

around the world.

We have put another great year in the books and now

look with excitement at new opportunities in 2012.

UPSers are ready to deploy our assets and know-how to

provide competitive advantages for our customers. At

the same time, our investors should enjoy another year

of record earnings per share. UPS is uniquely positioned

to capitalize on economic expansion, demographic

changes, and market development around the world.

D. Scott Davis

Chairman and Chief Executive Officer

UPS 2011 ANNUAL REPOR T

07

future

Diluted Earnings Per Share

(dollars)

3

4

5

2

1

0

07 08 09 10 11

4.23

3.58

2.13

Adjusted*

3.48

4.35

0.47

0.64

1.96

3.33

3.84

GAAP

Share Repurchase Expenditures

(billions of dollars)

3

4

2

1

0

07 08 09 10 11

2.6

3.6

0.6 0.8

2.7

5

Our brand is respected around the world and

our investments have positioned us to benefit

from economic growth.