UPS 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

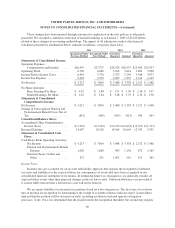

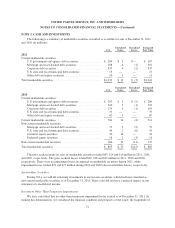

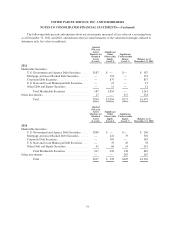

NOTE 2. CASH AND INVESTMENTS

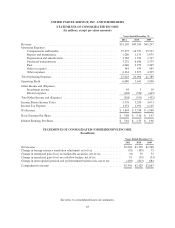

The following is a summary of marketable securities classified as available-for-sale at December 31, 2011

and 2010 (in millions):

Cost

Unrealized

Gains

Unrealized

Losses

Estimated

Fair Value

2011

Current marketable securities:

U.S. government and agency debt securities ............... $ 184 $ 3 $— $ 187

Mortgage and asset-backed debt securities ................. 188 4 (1) 191

Corporate debt securities ............................... 835 4 (2) 837

U.S. state and local municipal debt securities .............. 15 — — 15

Other debt and equity securities ......................... 10 1 — 11

Total marketable securities ................................. $1,232 $ 12 $ (3) $1,241

Cost

Unrealized

Gains

Unrealized

Losses

Estimated

Fair Value

2010

Current marketable securities:

U.S. government and agency debt securities ............... $ 207 $ 1 $ (2) $ 206

Mortgage and asset-backed debt securities ................. 220 3 (1) 222

Corporate debt securities ............................... 179 5 (1) 183

U.S. state and local municipal debt securities .............. 33 — — 33

Other debt and equity securities ......................... 62 5 — 67

Current marketable securities ............................... 701 14 (4) 711

Non-current marketable securities:

Mortgage and asset-backed debt securities ................. 79 2 (2) 79

U.S. state and local municipal debt securities .............. 49 2 (6) 45

Common equity securities .............................. 20 14 — 34

Preferred equity securities .............................. 16 1 (3) 14

Non-current marketable securities ........................... 164 19 (11) 172

Total marketable securities ................................. $ 865 $ 33 $(15) $ 883

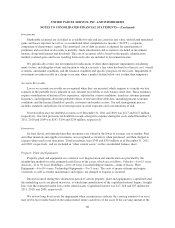

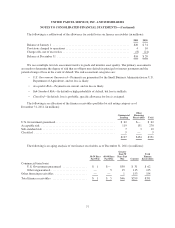

The gross realized gains on sales of marketable securities totaled $49, $24 and $16 million in 2011, 2010,

and 2009, respectively. The gross realized losses totaled $20, $18 and $12 million in 2011, 2010 and 2009,

respectively. There were no impairment losses recognized on marketable securities during 2011, while

impairment losses totaled $21 and $17 million during 2010 and 2009 (discussed further below), respectively.

Auction Rate Securities

During 2011, we sold all remaining investments in auction rate securities, which had been classified as

non-current marketable securities as of December 31, 2010. These sales did not have a material impact on our

statement of consolidated income.

Investment Other-Than-Temporary Impairments

We have concluded that no other-than-temporary impairment losses existed as of December 31, 2011. In

making this determination, we considered the financial condition and prospects of the issuer, the magnitude of

72