UPS 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

commodity and equity prices. For options and instruments with non-linear returns, models appropriate to the

instrument are utilized to determine the impact of market shifts.

There are certain limitations inherent in the sensitivity analyses presented, primarily due to the assumption

that exchange rates change in a parallel fashion and that interest rates change instantaneously. In addition, the

analyses are unable to reflect the complex market reactions that normally would arise from the market shifts

modeled. While this is our best estimate of the impact of the specified interest rate scenarios, these estimates

should not be viewed as forecasts. We adjust the fixed and floating interest rate mix of our interest rate sensitive

assets and liabilities in response to changes in market conditions. Additionally, changes in the fair value of

foreign currency derivatives and commodity derivatives are offset by changes in the cash flows of the underlying

hedged foreign currency and commodity transactions.

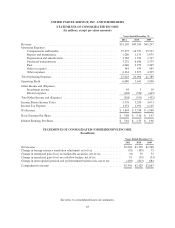

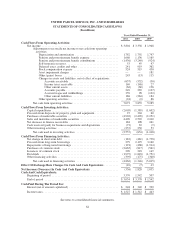

Shock-Test Result

As of December 31,

(in millions) 2011 2010

Change in Fair Value:

Currency Derivatives(1) ....................................... $(64) $(89)

Change in Annual Expense:

Variable Rate Debt(2) ......................................... $ 7 $10

Interest Rate Derivatives(2) .................................... $71 $58

(1) The potential change in fair value from a hypothetical 10% weakening of the U.S. Dollar against local

currency exchange rates across all maturities.

(2) The potential change in annual interest expense resulting from a hypothetical 100 basis point increase in

short-term interest rates, applied to our variable rate debt and swap instruments (excluding hedges of

anticipated debt issuances).

The sensitivity of our pension and postretirement benefit obligations to changes in interest rates is quantified

in “Critical Accounting Policies and Estimates”. The sensitivity in the fair value and interest income of our

marketable securities due to changes in equity prices and interest rates, respectively, was not material as of

December 31, 2011 or 2010. The sensitivity in the fair value and interest income of our finance receivables due

to changes in interest rates was also not material as of December 31, 2011 or 2010.

58