UPS 2011 Annual Report Download - page 50

Download and view the complete annual report

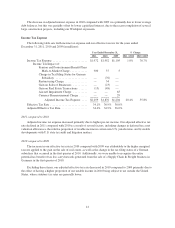

Please find page 50 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• The expense associated with our self-insurance programs for worker’s compensation claims increased

by $48 million in 2011. Insurance reserves are established for estimates of the loss that we will

ultimately incur on reported claims, as well as estimates of claims that have been incurred but not

reported. Insurance reserves also take into account a number of factors including our history of claim

losses, payroll growth and the impact of safety improvement initiatives. In 2010, we experienced more

favorable actuarial expense adjustments compared with 2011, thus leading to the increase in expense in

2011.

• Adjusted pension expense decreased $50 million in 2011 due to several factors. Most significantly,

contributions to the company-sponsored pension plans in 2011 increased the expected return on assets

used for expense calculation purposes. The increase in the expected return on assets more than offset

increased service and interest costs (due to a decline in discount rates), resulting in a net reduction in

pension expense. This was partially offset by higher contribution rates for multiemployer pension

plans, as well as the reinstatement of matching contributions to our primary employee defined

contribution savings plan.

2010 compared to 2009

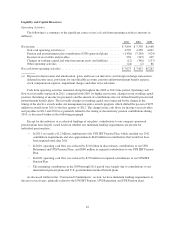

The increase in adjusted compensation and benefits expense in 2010 compared with 2009 was impacted by

several items. Payroll costs increased $416 million, largely due to higher accruals for management incentive

compensation plans resulting from improved company financial results. Union payroll costs also increased due to

contractual wage increases. These factors were partially offset by a decline in union labor hours, as well as a

reduction in management salary costs resulting from a decrease in the total number of management employees

through attrition combined with voluntary and involuntary workforce reductions.

Adjusted benefits expense increased $14 million in 2010 compared with 2009, due largely to increases in

health and welfare costs and relocation-related benefits for management employees. The increase in health and

welfare costs, which was primarily driven by health cost inflation, was somewhat mitigated by reductions in the

total number of management employees and union employees covered by UPS-sponsored health and welfare

benefit plans. The relocation benefit costs relate to the restructuring of our domestic package operations that

occurred in the first quarter of 2010. These increases were largely offset by a reduction in pension expense, due

to an increase in the expected return on assets more than offsetting increasing service and interest costs. The

increased expected return on assets was largely due to significant contributions to company-sponsored pension

plans in 2010.

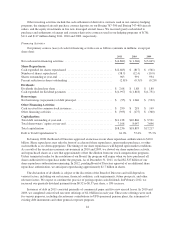

Repairs and Maintenance

2011 compared to 2010

The increase in repairs and maintenance expense was largely due to aircraft maintenance costs, which

increased $121 million in 2011 compared with 2010. This increase resulted from an increase in flight hours due

to higher air volume, additional scheduled maintenance checks and higher contractual maintenance rates. The

remaining increase in repairs and maintenance expense primarily relates to higher maintenance costs on our

office buildings and operating facilities.

2010 compared to 2009

The increase in repairs and maintenance expense in 2010 compared with 2009 was largely due to

maintenance costs on our vehicle fleet, which increased by $35 million during the year. The remaining increase

in repairs and maintenance expense was largely due to higher maintenance costs on our aircraft fleet and

operating facilities.

38